Customs Bond Guide for Amazon Sellers (2025): Single vs. Continuous Explained

Do I need a Customs Bond for Amazon FBA imports?

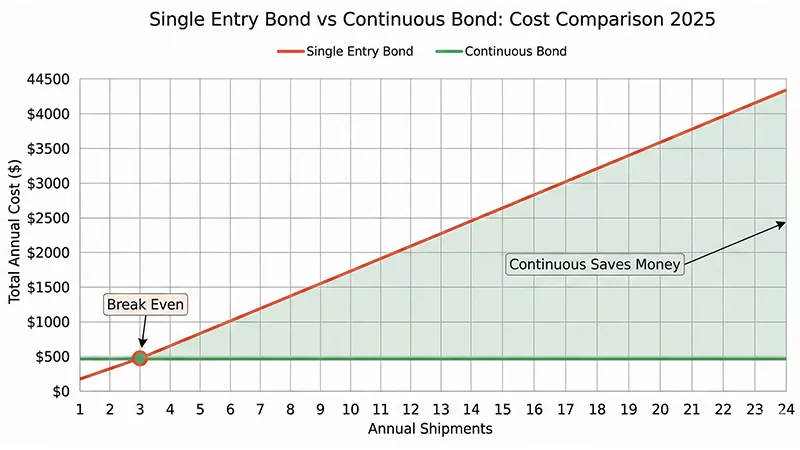

Yes. For any commercial import over $2,500, a customs bond is mandatory. You have two options: **Single Entry Bond ($175-225/shipment)** or Continuous Bond ($475/year). Verdict: If you ship 3+ times/year, choose the Continuous Bond. It saves $400-$1,625 annually, includes ISF coverage, and avoids the strict "5-Filing Limit" that blocks Single Entry Bond users.

I. Introduction: The Hidden "Tax" on Every Shipment

If you look closely at your freight invoice, you might see a line item: "Bond Fee: $100" or "ISF Bond: $75". Many Amazon FBA sellers pay this blindly on every shipment, thinking it is just another unavoidable shipping cost.

It is not. You might be overpaying by thousands of dollars.

A Customs Bond is non-negotiabl for serious importers. It is a financial guarantee to U.S. Customs (CBP) that you will pay your duties. But the decision between a Single Entry Bond and a Continuous Bond could save you $1,625+ per year—or cost you missed shipments and cargo holds.

In this guide, Zbao Logistics cuts through the confusion. We break down the exact costs for 2025, reveal the hidden "ISF Hard Cap" that catches sellers off-guard, and help you decide which bond matches your business.

II. What is a Customs Bond? (The $2,500 Rule)

The Legal Requirement

According to CBP Regulations, the bond requirement depends on value and usage:

-

De Minimis Rule (<$2,500): Personal imports often skip the formal bond.

-

Commercial Imports ($2,500+): A formal bond is mandatory. Do not risk shipping without one.

-

PGA Products (FDA/FCC): Always require a bond, regardless of value.

The 3-Party Agreement

A bond is NOT insurance for your cargo (that is Cargo Insurance). It is a legal contract between three parties:

-

You (Importer): Promise to pay duties and follow import rules.

-

Surety Company: Guarantees CBP you will pay; pays on your behalf if you default.

-

U.S. Customs (CBP): Holds the bond as collateral until cargo clears.

If you default, the Surety pays CBP—and then sues you for recovery. This is why Sureties are selective about approvals.

III. The Showdown: Single Entry vs. Continuous Bond

This is where you save money. Let's compare the two options side-by-side.

Quick Comparison Table (2025 Pricing)

| Feature | Single Entry Bond (SEB) | Continuous Bond (CB) |

| Coverage | One shipment only | Unlimited / 12 Months |

| Cost Per Shipment | $175 - $225 (Bond + ISF Bond) | ~$39 (if 12 shipments/year) |

| Annual Cost (Fixed) | Varies by volume | ~$475 / Year |

| ISF Filing Limit | 🚨 Max 5 per year (Hard Cap) | Unlimited |

| ISF Approval Time | ⚠️ 24-48 Hours (Slow) | ✅ Instant |

| PGA Products (FDA) | 🚨 3x Cost Multiplier | No Extra Cost |

| Surety Denial Risk | High (after 4-5 bonds) | Very Low |

| Best For | Trial Shipments (1-2/year) | FBA Sellers (3+/year) |

[Data Source: Zbao Logistics 2025 Market Research]

1. Single Entry Bond (SEB): The "Pay-As-You-Go" Trap

-

Definition: Covers one specific ocean shipment.

-

The Cost: ~$100 Premium + ~$75 ISF Bond = $175-$225 Total.

-

The Hidden Limit: CBP allows a maximum of 5 ISF filings per year using single bonds. If you try to ship a 6th container, CBP will reject the filing.

2. Continuous Bond (CB): The "Professional" Choice

-

Definition: Covers ALL shipments at ALL U.S. ports for 12 months.

-

The Cost: A flat annual fee (Market avg: $475/year).

-

The Bonus: It automatically includes ISF bond coverage. You never pay for an ISF bond again.

IV. The Math: When Should You Switch?

Do not guess. Look at the numbers.

The Breakeven Point is exactly 3 shipments.

The "Rule of 3" Breakeven Analysis

| Annual Shipments | Cost with SEB ($175/shipment) | Cost with Continuous Bond ($475/year) | Your Savings |

| 1 Shipment | $175 | $475 | -$300 (Loss) |

| 2 Shipments | $350 | $475 | -$125 (Loss) |

| 3 Shipments | $525 | $475 | +$50 (Save) |

| 5 Shipments | $875 | $475 | **+$400 (Save)** |

| 12 Shipments | $2,100 | $475 | **+$1,625 (Big Save)** |

Verdict: If you plan to ship 3 or more times in 2025, buy the Continuous Bond immediately.

V. The 3 Hidden Risks of Single Entry Bonds

Price isn't the only factor. Using Single Entry Bonds exposes your FBA business to three critical risks.

Risk #1: The "4th Bond Denial" Trap

It's not just CBP rules; Surety companies track your import pattern.

-

The Reality: After you buy 3-4 Single Entry Bonds, the Surety identifies you as a "Regular Importer" and will proactively DENY your next SEB request.

-

The Consequence: You are forced to buy a Continuous Bond mid-year anyway, wasting the money you spent on the first few bonds.

Risk #2: The PGA "Collateral" Shock ($1,000+ Deposit)

If you import electronics (FCC), cosmetics (FDA), or toys (CPSC), this rule destroys your cash flow.

-

The Rule: For PGA-regulated products, the SEB amount must be 3 times the value of the goods.

-

The Shock: Sureties often demand an Irrevocable Letter of Credit (ILOC) as collateral for these high-value bonds. This ties up $1,000-$3,000 of your cash.

-

Solution: A Continuous Bond bypasses this collateral requirement completely.

Risk #3: The ISF "BOL Mismatch" Error

ISF Filing must be done 24 hours before loading.

-

Common Error: Your ISF has BOL #12345, but the carrier's actual BOL is #12354.

-

The Cost: With an SEB, amending this requires Surety re-approval (24 hours). You will likely miss the deadline and face a $5,000 penalty. With a CB, amendments are instant.

VI. Foreign Importers: Can I Get a Bond Without a US Company?

Yes. This is a common hurdle for China-based Amazon sellers who act as the Importer of Record (IOR).

Most U.S. surety companies refuse to issue bonds to foreign entities directly.

The Zbao Solution: CBP Form 5106

As your freight forwarder, Zbao Logistics helps you file CBP Form 5106 (Importer Identity Form).

-

We designate you as the IOR.

-

We list Zbao as your Customs Agent.

-

The Surety bonds Zbao's handling of your cargo.

Result: You get a Continuous Bond without needing a U.S. LLC.

VII. How to Get a Bond (Step-by-Step)

You don't need to navigate CBP.gov (they don't issue bonds anyway). Here is the process with Zbao:

-

Contact Us: Tell us your annual shipment volume.

-

Documents: Provide your Company Name, Address, and Commodity Description.

-

Approval: We secure the bond via a licensed surety (typically 24-48 hours).

-

Active: Your bond is linked to your Importer Number (EIN) in the ACE system.

VIII. FAQ: Common Questions

Q: Is the Continuous Bond refundable if I stop shipping?

A: No. It is an insurance premium, not a deposit. The fee is non-refundable.

Q: Can I use one Continuous Bond for both Air and Sea freight?

A: Yes! Your bond covers all modes of transport at all U.S. ports. You can use it with Zbao for sea freight and DHL/FedEx for air freight.

Q: What happens if I don't have a bond?

A: CBP will not release your cargo. It will sit at the port accruing demurrage fees ($200-$400/day) until a bond is secured. Learn more about delays in our Customs Holds Guide.

IX. Conclusion: Stop Renting, Start Owning

In 2025, sticking with Single Entry Bonds is like renting a hotel room for a year—it costs a fortune and offers zero security.

If you are a serious Amazon FBA seller shipping 3+ times a year (especially during Peak Season), the Continuous Bond is the only logical choice. It saves you $1,625+, removes the ISF filing limit, and simplifies compliance for PGA products.

Ready to stop wasting money?

Zbao Logistics can set up your Continuous Bond today, ensuring your next shipment clears customs without delay.

👉 Get Your Continuous Bond Quote Now