Cargo Insurance Guide for Amazon FBA & E-Commerce Sellers

Introduction: Why Cargo Insurance Matters

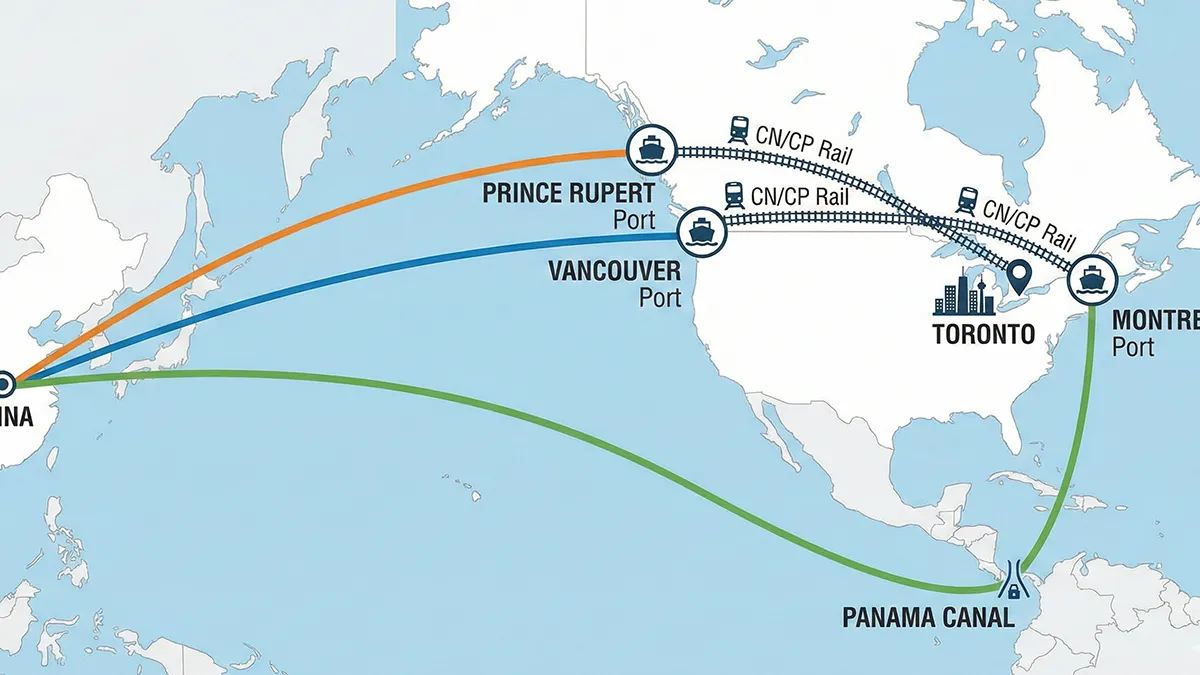

Shipping goods across borders is the backbone of modern e-commerce, but it comes with significant risk. From factory floors in China to Amazon warehouses in North America or Europe, goods travel thousands of miles by truck, ship, and plane. Along the way, they face storms, theft, accidents, mismanagement, and even geopolitical disruptions.

For Amazon FBA sellers and international e-commerce businesses, these risks can lead to massive financial losses. Carrier liability offers minimal protection — often pennies on the dollar — leaving sellers exposed. This is where cargo insurance (also called freight insurance or cargo coverage) becomes an essential safeguard.

In this comprehensive guide, we’ll cover everything you need to know about cargo insurance, including how it works, what it covers, common exclusions, types of policies, costs, and best practices. Most importantly, we’ll explain why partnering with an experienced freight forwarder like Zbao Logistics — an Amazon SPN-certified service provider with Amazon Ship Track support — ensures your business is protected end-to-end.

What Is Cargo Insurance?

Cargo insurance is a specialized policy that protects the value of goods during transportation by sea, air, rail, or truck. Unlike carrier liability, which is legally limited and based on weight rather than value, cargo insurance covers the full commercial invoice value of your goods.

For example:

-

A lost pallet weighing 500 kg shipped by air may only be reimbursed at 19 SDR per kilo (roughly $25/kg) under the Montreal Convention. That’s $12,500 compensation for cargo worth $80,000.

-

With cargo insurance, the entire $80,000 invoice value is protected, plus freight and up to 10% additional charges.

👉 Incoterms 2020 official guidance clarifies which party is responsible for insurance in global contracts. But for FBA sellers and importers, it’s almost always safer to arrange your own coverage.

Why Carrier Liability Is Not Enough

Many first-time importers mistakenly assume the carrier’s liability coverage will protect them. In reality, liability is minimal:

-

Air freight: 19 SDR/kg (≈ $25/kg).

-

Sea freight: 2.5 SDR/kg or 835 SDR per package under Hague-Visby Rules.

-

Truck freight (CMR Convention): 8.33 SDR/kg.

That means if your $100,000 shipment is damaged in transit, you might only recover $2,000–$5,000 from the carrier. The rest is your loss — unless you have proper cargo insurance.

Types of Cargo Insurance Policies

There are several cargo insurance options, each suited to different risk levels:

-

All-Risk Coverage

-

The most comprehensive policy. Covers almost all physical loss or damage from external causes (except exclusions).

-

Best for high-value, fragile, or time-sensitive goods.

-

-

Named Perils Coverage

-

Only covers specific listed risks (fire, sinking, theft, collision).

-

Cheaper, but limited in protection.

-

-

Open Cover Policy

-

An annual policy covering multiple shipments.

-

Ideal for frequent shippers (FBA sellers, distributors).

-

-

Contingent Insurance

-

Backup coverage when primary insurance fails.

-

Common in complex supply chain arrangements.

-

-

Total Loss Only (TLO)

-

Covers complete loss of a shipment (e.g., container lost at sea).

-

Doesn’t cover partial damages.

-

-

Mode-Specific Policies

-

Marine cargo insurance – for ocean shipments.

-

Air cargo insurance – covers high-value or urgent air freight.

-

Land cargo insurance – for trucking or rail.

-

Common Exclusions in Cargo Insurance

Even comprehensive policies don’t cover everything. Be aware of exclusions:

-

Improper packaging – If goods aren’t packed to withstand international transit.

-

Inherent vice – Natural decay, spoilage, or chemical self-reactions.

-

Willful misconduct – Intentional damage by the insured.

-

Loss due to delay – Missed sales windows are not covered.

-

Insolvency of carrier – Bankruptcy of shipping company isn’t usually covered.

That’s why choosing the right partner matters. At Zbao Logistics, we help sellers ensure goods are properly packed and compliant before shipping, reducing the risk of claim rejections.

7 Core Reasons Your Business Needs Cargo Insurance

-

Protection Against Transportation Risks

According to the World Shipping Council, an average of 1,566 containers were lost at sea annually between 2008 and 2022, rising to 2,301 annually from 2020–2022. -

Coverage for Theft and Pilferage

Cargo theft in North America costs billions annually. Insurance protects high-value e-commerce goods like electronics, apparel, and beauty products. -

Safeguard from Natural Disasters

Typhoons, earthquakes, and floods can wipe out entire shipments. -

Financial Recourse for General Average

If part of a ship’s cargo is sacrificed to save the vessel, all owners share the loss. Insurance covers your share. -

Mitigation of Supply Chain Disruptions

Incidents like the Ever Given blocking the Suez Canal in 2021 caused daily losses of $9.7 billion in trade. -

Compliance With Trade Regulations

Some contracts and letters of credit require insurance. -

Peace of Mind

Sellers can focus on growth instead of disaster scenarios.

Business Benefits of Cargo Insurance

Beyond risk management, cargo insurance provides tangible benefits:

-

Financial Protection – Covers invoice value + freight + 10%.

-

Operational Continuity – Prevents stockouts, enables faster recovery.

-

Customs Compliance – Smooths clearance at borders.

-

Enhanced Credibility – Shows partners and banks you are serious.

How Much Does Cargo Insurance Cost?

Cargo insurance is generally affordable compared to the risk.

-

Marine cargo insurance: 0.2%–0.5% of cargo value.

-

$100,000 shipment = $200–$500 premium.

-

-

Air cargo insurance: ~0.5% of cargo value.

-

Truck cargo insurance: Annual policies $400–$1,800.

👉 Example: A $20,000 shipment + $3,000 freight = $23,000 insured value. Add 10% buffer = $25,300 coverage. At 0.5%, insurance costs just $126.50 — far cheaper than a potential $25,000 loss.

For updated market insights, see Allied Market Research cargo insurance report.

How to Obtain Cargo Insurance

There are two ways:

-

Through an insurance broker

-

Through your freight forwarder

For most e-commerce sellers, the second is better. As an Amazon SPN-certified partner, Zbao Logistics integrates cargo insurance directly into your shipping plan, ensuring no gaps. We also leverage OA Alliance preferred pricing for faster approvals (1–2 days).

Learn more about our Amazon FBA shipping solutions ›

Best Practices for Managing Cargo Insurance Claims

-

Inspect immediately on delivery.

-

Document everything with photos and delivery receipts.

-

Notify both insurer and carrier immediately.

-

Preserve packaging and goods until claim survey is done.

-

Gather paperwork – invoice, packing list, bill of lading, etc.

4 Tips to Optimize Cargo Insurance Coverage

-

Accurately declare value (invoice + freight + 10%).

-

Ensure proper packaging with supplier support.

-

Understand your deductible to avoid surprises.

-

Work with experienced partners like Zbao Logistics (Amazon SPN + NVOCC + FMC-certified).

Zbao Logistics: Your Trusted Partner

Choosing the right insurance is as critical as choosing the right forwarder. With:

-

20+ years of logistics expertise

-

Certified Amazon SPN partner

-

Amazon Ship Track support

-

In-house customs brokerage and trucking in North America

…Zbao Logistics provides seamless door-to-door protection. From China’s factory floor to Amazon’s warehouse shelf, your cargo is safeguarded every step of the way.

Contact us today for a free logistics and insurance quote ›

Frequently Asked Questions (FAQ)

Q1: Is cargo insurance legally required?

Not always, but many contracts and Incoterms (like CIF) require it. Even when not mandatory, it’s strongly recommended.

Q2: How much does $100,000 of cargo insurance cost?

Typically $200–$500 depending on goods, mode, and route.

Q3: What does cargo insurance cover?

Physical loss or damage from accidents, theft, natural disasters, and other external causes.

Q4: What doesn’t it cover?

Improper packaging, inherent vice, delays, and intentional misconduct.

Q5: Do I need cargo insurance if my carrier has liability?

Yes. Carrier liability is minimal and won’t cover full cargo value.

Q6: What’s the difference between cargo insurance and freight insurance?

They’re often used interchangeably. Both cover goods in transit by sea, air, or land.

Q7: Can I buy single-trip coverage?

Yes, policies can be arranged per shipment or as annual open cover.

Q8: What is General Average?

A maritime law requiring all cargo owners to share losses if part of cargo is sacrificed to save the ship. Insurance covers your share.

Q9: Is cargo insurance tax-deductible?

Yes, it’s usually treated as a business expense.

Q10: How fast are claims settled?

With proper documentation, claims can settle within weeks. Partnering with Zbao Logistics ensures faster resolution.

Q11: Does cargo insurance cover Amazon FBA shipments?

Yes, whether shipping by sea or air, cargo insurance can cover goods going to Amazon FCs.

Q12: What’s the difference between All-Risk and Named Perils?

All-Risk covers almost all external risks. Named Perils only covers specific listed events.

Conclusion

International shipping is unpredictable. Without cargo insurance, sellers risk devastating financial losses from accidents, theft, or disasters.

For Amazon FBA and e-commerce sellers, cargo insurance is not a luxury — it’s a strategic necessity. By partnering with Zbao Logistics, you gain:

-

Comprehensive insurance coverage

-

Integrated Amazon SPN and Ship Track support

-

Faster approvals through OA Alliance

-

Seamless customs and delivery with in-house North American operations

💡 Ship smarter, safer, and more confidently.

Get your free quote from Zbao Logistics today ›