What Is ISF in Shipping and Why It’s Needed (2025 Guide)

At Zbao Logistics, we help global sellers and importers ship goods from China to the United States safely and compliantly.

One of the most critical U.S. import regulations every shipper should know is the ISF — Importer Security Filing, often referred to as the “10 + 2 rule.”

Introduced by U.S. Customs and Border Protection (CBP) after the September 11 attacks, ISF filing has been mandatory for all ocean freight shipments bound for the United States since 2009. Filing ISF accurately and on time is essential to avoid penalties, delays, or cargo seizures.

This guide explains what ISF means in shipping, how it works, when it must be filed, and why it’s critical for compliance — plus how Zbao Logistics ensures our clients’ shipments always clear smoothly.

1. What Does ISF Mean in Shipping?

ISF stands for Importer Security Filing, a data submission requirement by U.S. Customs and Border Protection (CBP). It requires importers (or their agents) to electronically submit specific cargo information before goods are loaded on a vessel headed to the United States.

The ISF rule — also known as the 10 + 2 regulation — was created to strengthen U.S. homeland security and prevent high-risk or illegal shipments from entering the country.

Key facts:

-

ISF applies only to ocean freight shipments (FCL & LCL).

-

Air freight and express courier shipments are not required to file ISF.

-

ISF must be filed at least 24 hours before the vessel departs from the origin port.

If ISF isn’t filed correctly, your cargo can be delayed, fined, or even refused entry by U.S. Customs.

📘 For the official rule and policy, see the CBP Importer Security Filing Guide.

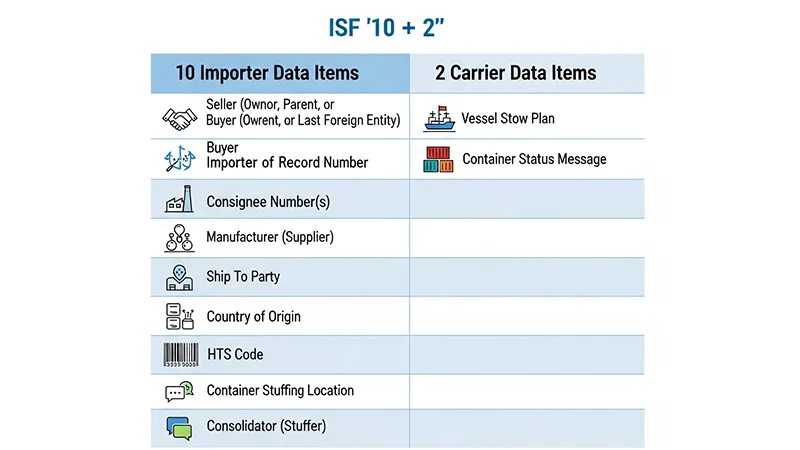

2. Understanding the ISF 10 + 2 Rule

The name “10 + 2” refers to 10 data elements provided by the importer and 2 data elements provided by the carrier.

| Filed by Importer (10 items) | Filed by Carrier (2 items) |

|---|---|

| Seller (Owner) name & address | Vessel stow plan |

| Buyer (Owner) name & address | Container status message |

| Importer of record number | |

| Consignee number | |

| Manufacturer (Supplier) name & address | |

| Ship-to party | |

| Country of origin | |

| Commodity HTSUS code (6-digit) | |

| Container stuffing location | |

| Consolidator (Stuffer) name & address |

Why “10 + 2” matters:

CBP uses this information to evaluate and flag potential risks before the vessel arrives. Compliant importers are less likely to face inspections or shipment delays.

🖼️ Visual tip: imagine an infographic showing the workflow — importer → CBP → carrier → U.S. Customs — all working to secure global trade.

3. When and How to File ISF

Filing Deadline

Importers must file ISF no later than 24 hours before the vessel leaves the origin port.

For example, if your shipment departs from Shenzhen on June 1 at 10:00 p.m., the ISF must be filed before May 31 at 10:00 p.m. local port time.

Who Is Responsible?

The Importer of Record (IOR) is legally responsible for the filing, even if a freight forwarder or customs broker handles the submission.

At Zbao Logistics, we automatically complete ISF and AMS filings for our DDP clients to ensure 100% compliance.

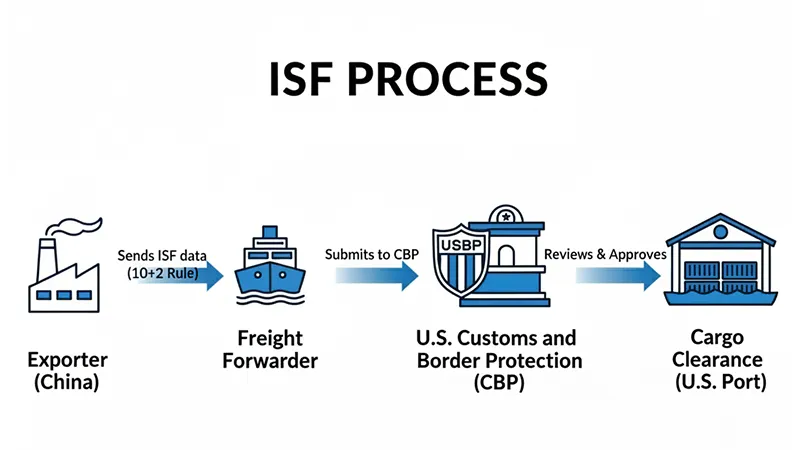

Step-by-Step ISF Filing Process

-

Collect shipment details: Seller, buyer, HTS code, stuffing location, consolidator info.

-

Submit through CBP’s ACE system: Your freight forwarder or broker files the data electronically.

-

Receive ISF number: CBP returns a confirmation of acceptance.

-

Verify accuracy: Ensure the ISF data matches your Bill of Lading before departure.

-

Cargo departs: Once accepted, cargo can safely load on the vessel.

If you’re new to customs compliance, you can also explore our detailed guide on Customs Clearance for Amazon FBA, where we explain how ISF fits into the overall import process.

4. Why ISF Filing Is Important

Many new importers overlook ISF because it seems like “just another form.” In reality, it’s one of the most critical compliance steps for shipments entering the U.S. by sea.

🛡️ 1. National Security

ISF was established to prevent terrorism and improve port security. CBP uses the data to screen for potentially dangerous cargo.

⚙️ 2. Risk Management

Advanced filing allows CBP to pre-assess risks and reduce unnecessary physical inspections for compliant shippers.

🚚 3. Faster Customs Clearance

If your ISF is filed correctly and on time, your shipment will typically clear faster — saving you demurrage and warehouse storage fees.

💰 4. Avoid Penalties

Failing to file or filing inaccurate ISF data can result in fines of up to USD 10,000 per shipment, plus cargo holds and delivery delays.

5. ISF Filing Fees and Penalties

| Violation Type | Description | Possible Penalty |

|---|---|---|

| Failure to File ISF | No ISF submitted before departure | Up to $5,000 per shipment |

| Late Filing | Filed after vessel departure | Up to $5,000 |

| Incorrect Information | Data doesn’t match Bill of Lading | Up to $5,000 |

| Failure to Update / Withdraw | Not correcting outdated ISF | $5,000 |

| Unauthorized Loading | Cargo shipped without ISF approval | Cargo seizure / hold |

Typical ISF filing service fee: USD 25–50 per shipment.

At Zbao, we include ISF filing in our China to USA DDP Shipping service — no hidden fees.

6. Real Example: China → USA ISF Filing

Let’s look at a real case handled by Zbao Logistics.

Shipment Details:

-

Origin: Shenzhen, China

-

Destination: Amazon FBA Warehouse (ONT8, California)

-

Cargo: 1 × 40HQ container of electronics

-

Vessel: COSCO “Asia Spirit”

-

Transit Time: 15 days

Process Overview:

-

Our operations team collected ISF data from the supplier (manufacturer, HTS code, stuffing location).

-

We filed ISF & AMS through our U.S. customs broker 24 hours before vessel departure.

-

CBP confirmed ISF acceptance (“green status”).

-

Cargo departed Yantian Port → arrived in Los Angeles → cleared within one business day.

✅ Result:

No inspection, no delay, no penalty — just smooth customs clearance and direct delivery to Amazon.

At Zbao Logistics, every DDP shipment from China to the U.S. includes full ISF + AMS compliance, ensuring your FBA cargo clears customs without risk.

📞 Get a Free DDP Quote »

7. What Happens If You Don’t File ISF

Not filing ISF is one of the most common — and costly — mistakes made by new importers.

Consequences:

-

💸 Monetary Penalties: Up to $10,000 per violation.

-

🚫 Cargo Holds: CBP can prevent unloading until ISF is accepted.

-

🕒 Delays: Late filings cause port congestion and demurrage costs.

-

⚠️ Flagged Importer Record: Future shipments face higher inspection rates.

-

📦 Cargo Seizure: In extreme cases, goods can be seized at port.

Remember: The responsibility lies with the importer, even if your supplier or forwarder “forgets.”

Working with Zbao ensures this never happens — ISF is automatically filed for every shipment.

8. Who Files ISF — Importer or Forwarder?

By law, the importer of record must ensure ISF is filed.

However, in practice, most importers authorize their freight forwarder or customs broker to handle the process on their behalf.

At Zbao Logistics, we provide a complete end-to-end compliance service:

-

ISF + AMS filing before vessel departure

-

Customs clearance upon arrival

-

Final delivery to Amazon FBA or U.S. warehouse

This means you don’t have to worry about CBP paperwork, timelines, or fines.

9. ISF vs AMS — What’s the Difference?

Both ISF and AMS filings are required for U.S.-bound shipments, but they serve different purposes.

| Aspect | ISF (Importer Security Filing) | AMS (Automated Manifest System) |

|---|---|---|

| Filed By | Importer or broker | Carrier or forwarder |

| Filing Deadline | 24 hours before vessel departure | Before vessel arrival |

| Purpose | Cargo risk assessment | Cargo manifest submission |

| Applies To | Ocean freight only | Ocean + Air freight |

| Legal Reference | CBP 10 + 2 Rule | 19 CFR 4.7A |

If your freight forwarder only handles AMS and not ISF, your shipment is still non-compliant.

Zbao handles both filings together, ensuring seamless U.S. Customs clearance.

📘 For more about freight tracking and rates, see Freightos Global Freight Index.

10. Frequently Asked Questions

1. Who files the ISF — importer or forwarder?

The importer of record is legally responsible, but your freight forwarder or customs broker can file on your behalf.

2. Is ISF required for air shipments?

No. ISF applies only to ocean shipments.

3. When must ISF be filed?

At least 24 hours before the vessel leaves the origin port.

4. How much does ISF filing cost?

Typically between USD 25–50, depending on the forwarder and port.

5. Can ISF be amended after filing?

Yes, corrections can be made before vessel arrival in the U.S.

11. Conclusion

ISF (Importer Security Filing) is not optional — it’s a fundamental part of international shipping compliance.

Every ocean shipment bound for the United States must have an ISF filed correctly and on time.

Filing ISF ensures:

-

✅ Smooth customs clearance

-

✅ Avoidance of penalties and delays

-

✅ A clean importer compliance record

At Zbao Logistics, we simplify this process for you.

Whether you’re an Amazon FBA seller or a large-scale importer, our DDP services include ISF, AMS, customs clearance, and door-to-door delivery — all handled by professionals who understand U.S. Customs inside out.

12. Call to Action

🚢 Need Help with ISF Filing or Customs Clearance?

Let Zbao Logistics handle your China–U.S. shipping from start to finish.

We manage ISF, AMS, customs clearance, FBA prep, and delivery — so you can focus on selling.

👉 Get a Free Quote Now »