DDP Shipping China to UK 2026: Costs, VAT & Transit Time Guide

If you are importing from China to the UK in 2026, you likely have two main concerns: "How much will it cost?" and "How do I handle the post-Brexit customs mess?"

You have probably asked a few forwarders for a DDP Door-to-Door shipping quote and received a confusing mix of answers. One forwarder quotes you per kilogram, another per CBM, and a third offers a suspiciously low "all-in" rate that doesn't mention VAT.

Here is the reality: Shipping to the UK is no longer just about moving boxes from A to B. Since Brexit, strict regulations involving EORI numbers, C79 certificates, and Postponed VAT Accounting (PVA) have changed the game.

This guide is written for UK importers, Amazon FBA sellers, and purchasing managers who need more than just a generic price list. We will provide you with:

-

Realistic Q1 2026 Cost Benchmarks: What you should actually be paying for Sea and Air freight.

-

The "VAT Trap": Why standard DDP might be costing your business 20% in lost cash flow.

-

Transit Times: The truth about "Fast Boat" options vs. standard LCL.

-

Actionable Tools: A copy-paste template to get accurate quotes instantly.

At Zbao Logistics, we don't just ship cargo; we help you navigate the complexity of UK logistics to protect your profit margins.

1. What Does "DDP Door-to-Door" Actually Mean in 2026?

Before we look at the costs, we must define the service. DDP (Delivered Duty Paid) is the most popular Incoterm for e-commerce sellers because it implies a "hassle-free" experience.

A true DDP Door-to-Door shipping service from China to the UK covers the entire supply chain:

-

Origin (China): Pickup from your supplier (Shenzhen, Yiwu, Ningbo, etc.), export clearance, and consolidation.

-

International Freight: The Sea or Air journey to UK ports (Felixstowe, Southampton, London Gateway).

-

Destination (UK): Import customs clearance, payment of Import Duty and Import VAT, port handling charges, and final delivery to your warehouse or Amazon FBA center.

The Critical "DDP" Warning

Many budget forwarders offer "DDP" but actually provide "DAP" (Delivered at Place), leaving you with a surprise bill for VAT and Duty upon arrival.

Rule #1: A genuine DDP quote is a single, all-inclusive price. If you receive a separate bill for taxes from DPD, UPS, or HMRC, it wasn't DDP.

2. 2026 Shipping Costs: China to UK Benchmarks (Q1 Estimates)

Freight rates change weekly based on fuel surcharges, Red Sea route adjustments, and demand. However, for Q1 2026 planning, you can use these indicative market ranges to benchmark your current quotes.

A. Sea Freight (LCL - Less than Container Load)

Best for: Small to medium shipments (1–15 CBM) or Amazon FBA restocks.

In 2026, LCL pricing is often quoted in two ways: Per CBM or Per KG.

| Volume Tier | Indicative DDP Rate (Door-to-Door) | What's Included? |

| 1 – 3 CBM | $120 – $180 USD / CBM | Pickup, Sea Freight, Clearance, Duty/VAT (Standard), Delivery. |

| 3 – 8 CBM | $100 – $150 USD / CBM | Economies of scale kick in. |

| 8 – 15 CBM | $80 – $130 USD / CBM | Approaching FCL efficiency. |

| Minimum Charge | 1 CBM / $150 | Even if you ship 0.5 CBM, you pay the minimum. |

-

Note: These rates assume general cargo (non-hazardous). High-tax items (like textiles or leather) will have higher DDP rates to cover the extra Duty.

B. Sea Freight (FCL - Full Container Load)

Best for: High volume importers shipping 20ft or 40ft containers.

-

40HQ Port-to-Port: $2,500 – $4,000 USD (Spot Market Low Season).

-

40HQ Door-to-Door (DDP All-in): $6,000 – $10,000+ USD.

-

Why the big range? The "All-in" DDP price depends heavily on your cargo's value. If you fill a container with $100,000 worth of electronics, the 20% VAT alone is $20,000. This is why FCL is rarely quoted as a flat "DDP" rate; it is usually quoted as Freight + Taxes at Actuals.

-

C. Air Freight (Door-to-Door)

Best for: Urgent launches, sample restocking, or high-value low-weight goods.

-

+100kg Level: $6.00 – $10.00 USD / kg (All-in DDP).

-

Express Courier (DHL/UPS): $8.00 – $12.00+ USD / kg.

-

Zbao Tip: Air freight rates are extremely volatile. Always check if our Express Sea service (approx. 30 days) can meet your deadline for 1/5th of the cost.

3. Transit Times: Standard vs. Fast Boat vs. Rail

Don't just ask "how long does it take?" Ask "how long until it is sellable?"

Many forwarders quote "Port-to-Port" times (e.g., 25 days) which is misleading. You need the Door-to-Door timeline.

Option 1: Standard Sea Freight (LCL)

-

Route: Shenzhen -> Transshipment (Singapore/Rotterdam) -> Felixstowe.

-

Port-to-Port: 30–35 Days.

-

Door-to-Door: 40–50 Days.

-

Verdict: The cheapest option. Good for regular stock replenishment where speed is not critical.

Option 2: Zbao "Fast Boat" (Express Sea)

-

Route: Direct sailing (e.g., Evergreen/Cosco/Matson equivalent) to UK main ports.

-

Port-to-Port: 23–28 Days.

-

Door-to-Door: 30–38 Days.

-

Verdict: The "Sweet Spot." Faster than standard LCL but significantly cheaper than Air or Rail. Ideal for Q4 prep.

Option 3: China-Europe Railway (The "Middle Way")

-

Route: Chongqing/Chengdu -> Poland/Germany -> Truck to UK.

-

Door-to-Door: 25–35 Days.

-

2026 Status: Due to ongoing geopolitical issues in Eastern Europe, rail reliability varies. It is currently faster than sea but costs approx. 2x more. Check with us for live feasibility.

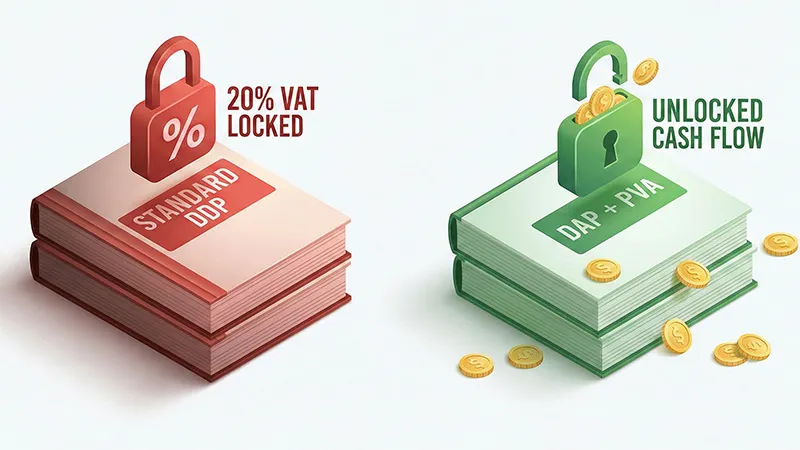

4. The "VAT Trap": Why B2B Buyers Should Avoid DDP

This is the most important section for UK business owners.

If you are a VAT-registered company in the UK, asking for "DDP Shipping" might be a financial mistake.

The Problem with Standard DDP

Under a standard DDP term, the seller (or the forwarder's agent) acts as the Importer of Record. They pay the Import VAT (20%) to HMRC.

-

The Issue: Because the import declaration is not made against your EORI number, the C79 Certificate (the proof required to reclaim VAT) is generated for the agent, not you.

-

The Result: You cannot reclaim that 20% VAT on your tax return. It becomes a sunk cost, increasing your product cost by 20%.

The Zbao Solution: DAP + PVA (Postponed VAT Accounting)

We recommend a smarter approach for B2B buyers: DAP Terms combined with PVA.

-

DAP (Delivered at Place): We handle shipping and delivery, just like DDP.

-

PVA (Postponed VAT Accounting): Instead of us paying the VAT upfront, we submit the customs entry using Your GB EORI Number.

-

The Benefit: You do not pay the Import VAT at the border. Instead, you simply "account" for it on your next VAT return.

Financial Impact:

-

DDP: You pay £2,000 VAT upfront (hidden in the shipping price) and struggle to reclaim it.

-

DAP + PVA: You pay £0 VAT upfront. You keep the cash in your business.

Expert Advice: If you have a valid GB VAT number, tell your forwarder: "I want a Door-to-Door quote using DAP terms, and I want to use Postponed VAT Accounting." Zbao Logistics specializes in this process.

5. Amazon FBA UK: Specific Delivery Requirements

Shipping to Amazon's UK fulfillment centers (like BHX4 in Coventry, LBA4 in Doncaster, or MAN4 in Chesterfield) requires strict compliance. Amazon UK is notorious for rejecting deliveries that don't meet their standards.

The "Last Mile" Matters

Once your goods clear customs at Felixstowe or Southampton, how do they get to Amazon?

-

Small Shipments (Cartons): We hand these over to DPD or UPS.

-

Pros: Fast, fully trackable, no booking appointment required (for approved carriers).

-

-

Large Shipments (Pallets): We inject these into a UK Pallet Network (like Palletways) or use dedicated trucks.

-

Requirement: Must be booked via Amazon's Carrier Central. Zbao handles this appointment scheduling for you.

-

Pallet Standards: UK pallets are different from US/EU pallets! We ensure your goods are on standard 1200x1000mm UK pallets (or Euro pallets if accepted), wrapped clearly, and labeled with FBA Box IDs.

-

6. How to Get an Accurate Quote (And Avoid Hidden Fees)

The biggest frustration for importers is the "Subject to Change" quote. To get a fixed, accurate price, you need to provide the right data.

Understanding Quote Formats: CBM vs. KG

-

Per CBM: Best for light, bulky cargo (e.g., pillows, plastic toys).

-

Per KG: Best for dense, heavy cargo (e.g., metal parts, liquids).

-

The Conversion: In sea freight, 1 CBM is typically calculated as 167kg or 300kg depending on the carrier. Zbao will always calculate both and offer you the cheaper billing method.

Copy-Paste Quote Request Template

Don't write a vague email. Copy this template and send it to us (or any forwarder) to get a professional, comprehensive quote within 24 hours.

Subject: DDP Shipping Quote Request - China to UK - [Your Company Name]

1. Pick Up Address: [City, China] (or "Supplier will send to your Shenzhen/Yiwu warehouse")

2. Delivery Address: [Full UK Postcode] (Specify if it is Amazon FBA or Private Warehouse)

3. Cargo Ready Date: [Date]

4. Cargo Details:

Commodity: [e.g., Silicone Phone Cases]

Material: [e.g., 100% Silicone] (Crucial for Duty Check)

Total Cartons: [e.g., 50 cartons]

Dimensions per Carton: [e.g., 50x40x30 cm]

Weight per Carton: [e.g., 12 kg]

5. Value: [Approximate USD Value of Goods] (Crucial for VAT calculation)

6. Service Required:

Option A: Standard Sea DDP

Option B: Fast Boat DDP

Option C: DAP + PVA (I have a GB VAT number: Yes/No)

7. Frequently Asked Questions (FAQ)

Q1: Do I need an EORI number to import from China to the UK?

Yes. Whether you are a business or a sole trader, you need a GB EORI number (starting with "GB") to import commercial goods into Great Britain. Without it, customs cannot process your entry, and your goods will be held at the port accruing storage fees.

Q2: What is the cheapest way to ship 100kg from China to the UK?

For 100kg, Sea Freight LCL is the cheapest option (approx. $150-$200 DDP), but it is slow (45 days). If you need it faster, Air Freight will cost approx. $600-$900 but arrive in 7 days. Rail is a middle ground but has high minimum volume requirements.

Q3: Does Zbao handle UK Import Duty and VAT payments?

Yes. Under our standard DDP service, we pay the Duty and VAT to HMRC on your behalf. The cost is included in your all-in quote. However, if you are a VAT-registered business, we strongly suggest our DAP + PVA service to improve your cash flow (see Section 4).

Q4: How much is UK Import Duty?

Import duty rates vary by product HS Code.

-

Consumer Electronics: Often 0%.

-

Clothing/Textiles: Typically 12%.

-

Plastic Articles: Typically 6.5%.

Import VAT is almost always 20% calculated on the (CIF Value + Duty).

Q5: Why is my "DDP" quote per KG and not per CBM?

"Ecommerce DDP" lines are often priced per KG because the final mile delivery cost in the UK (via DPD/UPS) is charged by weight. This simplifies the pricing model for Amazon sellers. It is normal and often cheaper for dense goods.

Conclusion: Stop Guessing, Start Planning

Shipping from China to the UK in 2026 requires a partner who understands more than just "freight." You need a partner who understands Brexit regulations, PVA tax efficiency, and Amazon FBA compliance.

Don't settle for a vague quote that leaves you exposed to hidden port fees or un-reclaimable VAT.

Optimize your UK supply chain today.

Whether you need the speed of our Fast Boat service or the cash-flow benefits of PVA Clearance, Zbao Logistics has the solution.