Amazon FBA Canada 2026: CARM, GST/HST & NRI Logistics

If you are an Amazon seller shipping inventory from China to Canada (FBA), the landscape has shifted significantly in 2026.

For years, the Canadian import process was relatively flexible, allowing forwarders to manage clearance with minimal seller involvement. That era is over. With the full implementation of the CBSA Assessment and Revenue Management (CARM) system, the Canadian border has undergone a systemic digital transformation.

The Reality in 2026:

-

CARM is Mandatory: The importer (you) must now be directly registered in the CBSA system.

-

Compliance is Key: "All-In" DDP rates that obscure duty/tax details are facing increased scrutiny.

-

Tax Efficiency Matters: Operating as a registered Non-Resident Importer (NRI) allows you to potentially recover the 5% GST on imports—a critical margin booster that many sellers miss.

At Zbao Logistics, we specialize in Compliant NRI Logistics. We don't just move your boxes; we help you navigate these regulatory changes to protect your profit margins.

Part 1: The CARM Reality (Why You Can't Outsource This)

The single biggest change in 2026 is CARM. It has fundamentally changed the relationship between the importer, our brokerage team, and the CBSA.

The Old Way: Freight forwarders or customs brokers could often file entries under their own bond, keeping the seller in the background.

The New Way (2026): The Importer of Record (You) must be registered in the CARM Client Portal (CCP) to maintain visibility and liability.

If you are not properly registered:

-

Clearance Delays: Our customs broker may be blocked from filing a release declaration without your digital delegation.

-

Border Holds: Without a valid importer account, goods can be held at the port, leading to storage fees.

-

Financial Security: The new Release Prior to Payment (RPP) program requires importers to post financial security (often via a surety bond) to release goods before paying duties.

The 3-Step Compliance Checklist:

-

Get a BN9: You must obtain a Business Number (BN9) from the Canada Revenue Agency (CRA). Note: This identifies your business to the Canadian government.

-

Register in CCP: Log in to the CARM Client Portal using a "GCKey" or "Sign-In Partner".

-

Delegate Authority: Inside the portal, you must formally "Delegate Authority" to Zbao's partner broker. This digital handshake authorizes us to clear cargo on your behalf.

Zbao Support: While we cannot register for you (that would violate CBSA identity rules), our team provides a Step-by-Step CARM Guide to walk you through the setup process in under 20 minutes.

Part 2: The "All-In" Trap vs. The NRI Tax Advantage

Many sellers still look for "Cheap DDP" rates to Canada. However, under the new 2026 framework, understanding who pays the tax—and who gets it back—is critical for your profitability.

The Risk of Non-Transparent DDP

If a forwarder offers a flat rate that seems lower than "Ocean Freight + Duty + GST," it raises a compliance red flag.

-

Valuation Risk: CBSA is aggressively auditing shipments where the declared value appears artificially low to evade taxes. As the owner of the goods, you ultimately bear the liability for any reassessments.

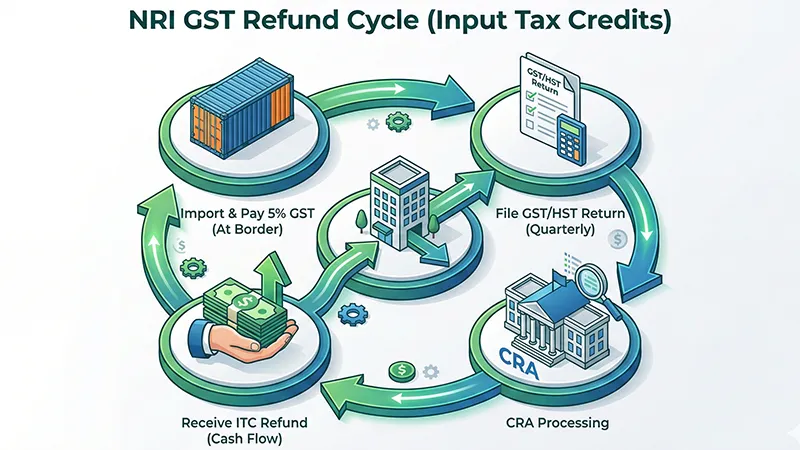

The "Tax Refund" Opportunity (Input Tax Credits)

Here is the financial advantage of using Zbao's Non-Resident Importer (NRI) service:

Canada charges 5% GST (Federal Tax) on most imports.

-

Scenario A (Non-Compliant DDP): If the forwarder acts as the importer to pay the tax, you (the seller) typically cannot claim the tax credit. That 5% is a sunk cost.

-

Scenario B (Zbao NRI Service): You register for GST/HST. You pay the 5% tax at the border under your own Business Number. You then file a return to claim it back as an Input Tax Credit (ITC).

The Potential Impact:

On $100,000 of inventory, recovering the GST could mean **$5,000 back in your cash flow**. Note: Tax recovery depends on your specific business structure and compliance with CRA filing requirements.

Expanding to other North American markets? Read our guide on Shipping to Amazon Mexico (FBA) to understand the differences between Canadian GST and Mexico's RFC tax requirements.

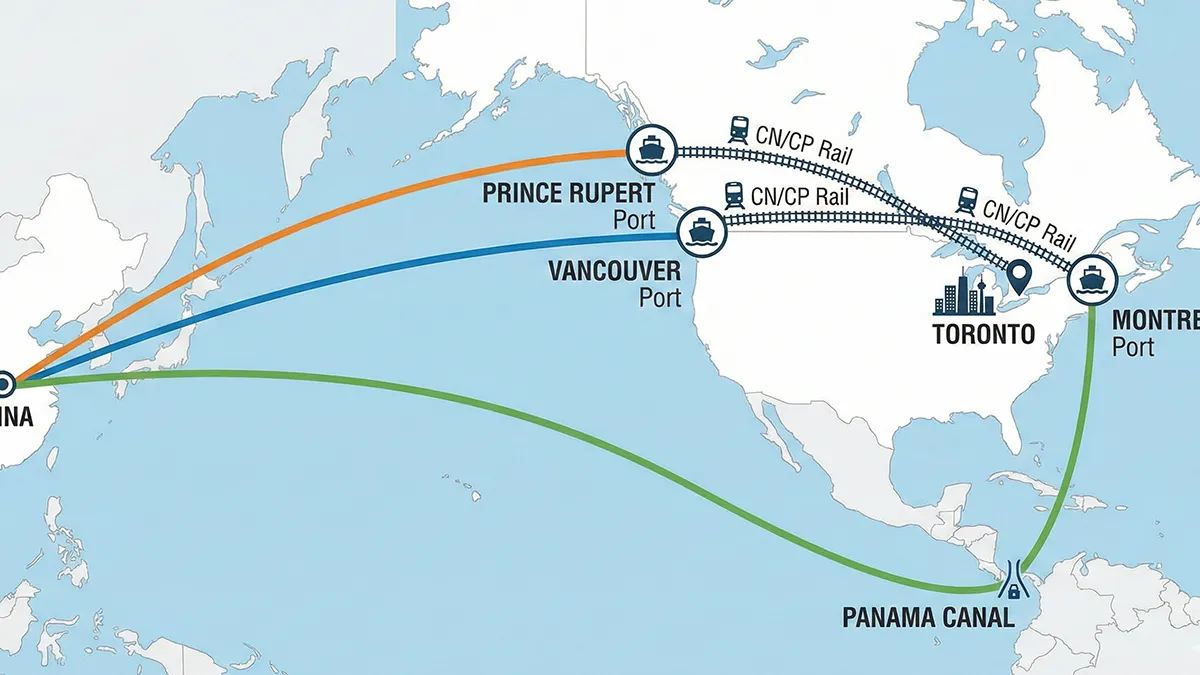

Part 3: Logistics Routing (Navigating the 2026 Map)

The Bottleneck: Vancouver (YVR)

Based on our operational data, Vancouver remains the primary gateway but faces persistent rail challenges.

-

Rail Dwell Time: During peak periods, our team often sees containers sit for 6–8 days waiting to load onto trains for Toronto.

-

Total Delay: It is not uncommon to see 14+ days of latency from vessel arrival to rail departure.

Zbao's Strategic Alternatives:

-

Prince Rupert (The Speed Option): We recommend this route for time-sensitive Q1/Q2 restocks. It is located further north with typically less yard congestion.

-

Halifax (The East Coast Strategy): For Q4 inventory, we advise shipping through the Panama Canal to Halifax. This allows us to bypass West Coast rail congestion entirely and truck directly to Toronto/Montreal.

Part 4: Amazon FC Rejection (Strict Pallet Rules)

Amazon Canada operates with stricter receiving standards than Amazon USA.

The #1 Rejection Reason: Pallet Height

-

Maximum Height: 1.7 meters (175 cm) including the pallet.

-

The Mistake: US limits are often higher (1.8m+). Sending US-spec pallets to YYZ4 (Brampton) often results in refusal at the dock.

-

The Cost: Re-stacking a rejected load can cost $500+ and add weeks of delay.

Carrier Central Appointments

Canada relies heavily on strict appointment slots.

-

The Reality: YYZ4 and YHM1 can experience 14–21 day delays for appointment slots during peak season.

-

Zbao Solution: We leverage our local trucking network to prioritize routing to less congested FCs like YEG2 (Edmonton) or YVR4 (Vancouver) when possible to speed up check-in.

FAQ: Canadian Shipping Questions

1. Can Zbao register for CARM for me?

No. CBSA requires the importer to register their own business account to establish liability. You must log in with your credentials to delegate authority to our broker.

2. Is GST/HST registration mandatory?

For Non-Resident Importers with sales exceeding $30,000 CAD, in many cases, registration is generally required. Financially, we highly recommend it because it allows you to claim Input Tax Credits (ITCs) on your imports.

3. What is the difference between DDP and NRI?

"DDP" is an Incoterm where the seller pays all costs. "NRI" describes your status as the Importer of Record. Zbao recommends the NRI model (where you are the importer) because it ensures compliance and allows for tax recovery.

Conclusion

Shipping to Canada in 2026 requires a shift in mindset. You are no longer just "sending a box"; you are acting as a legitimate global business.

-

You must register for CARM to clear customs.

-

You should structure your taxes to recover the 5% GST.

-

You need a logistics partner who understands these complexities, not just one who offers the cheapest rate.

Ready to Ship Compliantly?

Zbao Logistics helps you navigate the CARM portal, obtain your BN9, and ship with confidence.