Amazon FBA COGS 2026: The Phantom Profit & Tariff Guide

It is late December. You are finalizing your 2025 P&L statement. Sales revenue looks great, but your bank account balance is suspiciously low.

You are likely a victim of "Phantom Profit."

For 90% of Amazon Private Label sellers, the profit leak isn't in PPC spend or product quality. It’s in a flawed COGS (Cost of Goods Sold) calculation.

Many sellers treat logistics as a simple "bill to pay." But in the eyes of the IRS—and the harsh reality of 2026—freight is Inventory. With Section 301 Tariff Hikes hitting January 1st and Amazon’s new Placement Fees muddying the waters, getting your COGS wrong means you are likely pricing your products at a loss.

This guide combines IRS tax rules, the latest Trade Policy updates, and industry benchmarks to help you calculate your True Landed Cost for 2026.

Part 1: The IRS Reality (Freight is Inventory, Not Expense)

The most common mistake sellers make is treating shipping costs from China as an "Operating Expense" (deducted immediately).

According to IRS Section 471 and UNICAP Rules, "Freight-In" (the cost to get goods from China to the US) is a direct acquisition cost. It must be capitalized into your Inventory Valuation.

The "Cash Flow Trap"

If you spend $50,000 on shipping in December 2025, but you don't sell those goods until March 2026:

-

The Wrong Way (Expensing): You deduct $50k from your 2025 taxes. You feel rich now, but you have no deductions for those units when they sell in 2026.

-

The Right Way (Capitalizing): That $50k sits on your Balance Sheet as an Asset. You only deduct it as COGS when the unit sells. This aligns your costs with your revenue.

The "Small Business" Loophole (<$31M):

Under IRS Rev. Proc. 2024-40, if your 3-year average gross receipts are under $31 Million, you can choose to expense freight immediately if your internal books (e.g., QuickBooks) do the same.

Zbao Advice: While legal, this is dangerous for management. To price correctly, you MUST calculate freight into your unit cost. Don't let tax accounting distort your business logic.

Part 2: The 2026 Tariff Cliff (The "Lithium Shock")

While the November 2025 Trump-Xi Trade Deal extended exemptions for general electronics (laptops/phones), it masked a targeted hit for specific industrial categories.

Effective January 1, 2026, "Precision Tariffs" will strike three major industries. If you sell these, your Landed Cost is about to explode.

1. The "Lithium Shock" (Batteries)

-

Product: Lithium-Ion Batteries (Non-EV). Includes Power Banks, Tool Batteries, and replacement batteries for vacuums.

-

Old Rate: 7.5%

-

New Rate (Jan 1): 25%

-

Impact: Tripling of duties. A $20 battery now costs $3.50 more just to import.

2. The Medical Glove Crisis

-

Product: Nitrile & Latex Gloves.

-

Old Rate: 50%

-

New Rate (Jan 1): 100%

-

Impact: For every $1 of product, you pay $1 in tax. Sourcing from China is now mathematically unviable; shift sourcing to Malaysia or Thailand immediately.

3. The "Hidden" Component Tax (Magnets & Graphite)

-

Product: Permanent Magnets (Neodymium) & Natural Graphite.

-

Old Rate: 0%

-

New Rate (Jan 1): 25%

-

Impact: This hits DIY electronics kits, speakers, and magnetic toys.

Part 3: The 2026 Landed Cost Math (What Profitable Sellers Hit in 2025)

To survive 2026, you must stop looking at "Factory Price" and start managing "Landed Cost."

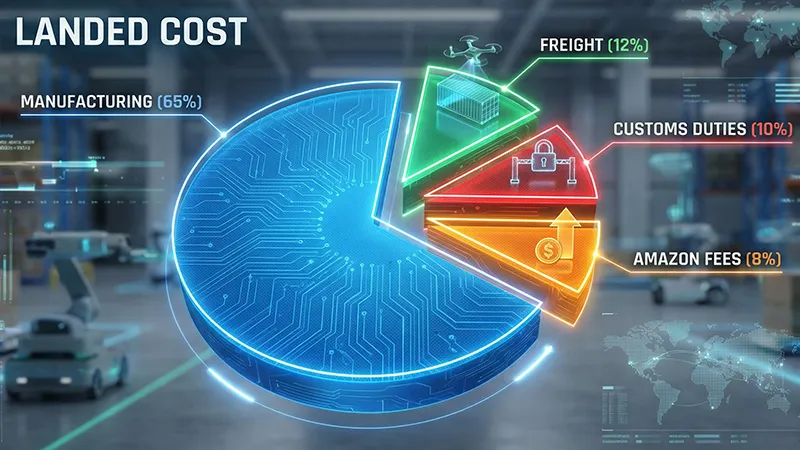

Based on data from our most profitable FBA clients in 2025, here is the benchmark you need to hit:

| Cost Component | Typical Share of Landed Cost | Healthy Range |

| 1. Manufacturing (Ex-Factory) | 65% - 75% | If <60%, your product may be too cheap/low quality. |

| 2. International Freight | 10% - 15% | Target: 12%. If >20%, you are over-using Air Freight or shipping inefficient LCL. |

| 3. Customs Duties | 5% - 12% | Warning: Will spike to 25-30% for Lithium/Furniture in 2026. |

| 4. Port / Broker / Insurance | 2% - 5% | Don't skip Cargo Insurance (it's only ~0.5%). |

| 5. Prep & Placement Fees | 3% - 8% | Includes the new Amazon Placement Fees. |

The "Healthy" Freight-to-COGS Ratio

Go to your spreadsheet. Divide your Total Freight Spend by your Total COGS.

-

8-10% (Excellent): You are shipping Full Containers (FCL) efficiently.

-

10-15% (Standard): You are healthy.

-

>20% (Critical): You are bleeding profit. This often happens when sellers get stuck paying detention fees when shipping to congested hubs like GYR3, or when they rely too heavily on expensive LCL shipping.

Part 4: The 2026 Amazon Fee Controversy

Effective 2026, Amazon's Inbound Placement Service Fee is a major line item.

Is it COGS or Operating Expense?

The accounting consensus is split based on size:

-

For Large Sellers (>$31M): Under IRS Section 263A (UNICAP), "Handling costs" and "transport between facilities" must be capitalized. This fee is technically COGS.

-

For Small Sellers (<$31M): You can likely treat it as an Operating Expense (Fulfillment Cost).

The Zbao Solution:

Instead of arguing with your CPA about how to categorize this fee, eliminate it.

By using Zbao Transloading in LA, we sort your cargo into Amazon's required "Minimal Splits" configuration before it hits their dock. You pay standard freight (which is cheaper) and avoid the confusing Amazon Placement Fee penalty entirely.

Part 5: Strategic Moves to Lower COGS

Your accountant records your COGS. Zbao lowers it. Here is how we defend your margins in 2026:

1. Section 321 (The "Duty-Free" Loophole)

For the new 25% tariff items (Lithium Batteries, Magnets), consider Section 321 Fulfillment.

-

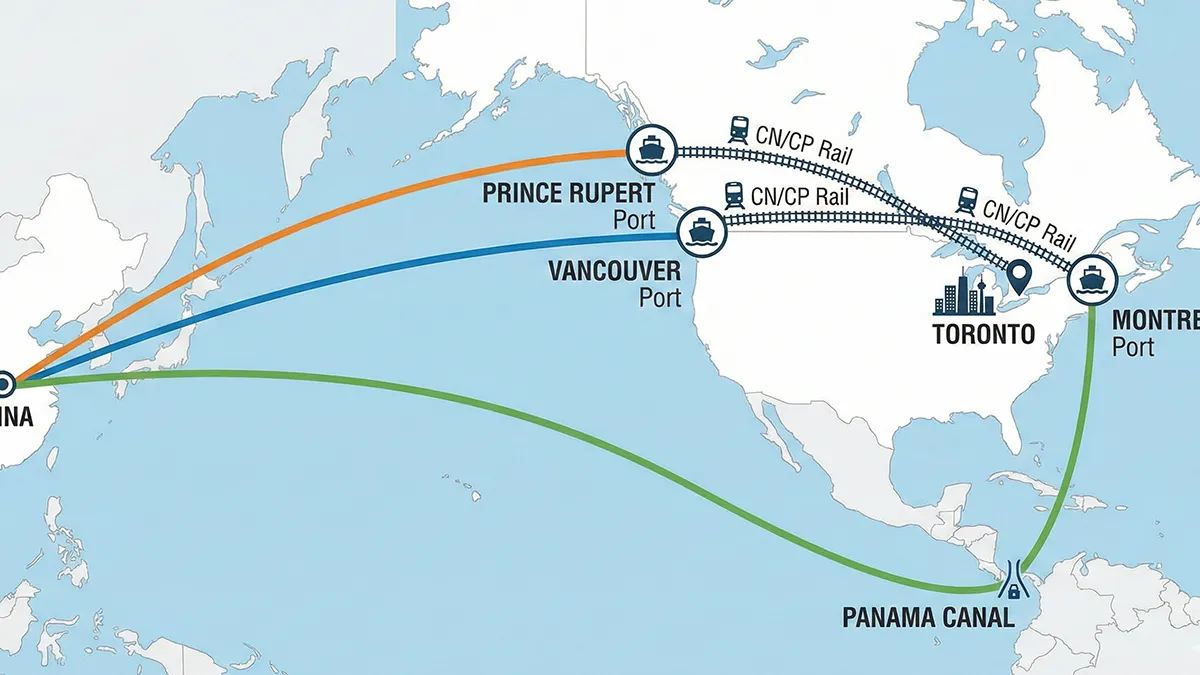

Strategy: Ship bulk inventory to our partner warehouse in Mexico (Tijuana) or Canada.

-

Execution: Fulfill B2C orders directly to US customers one by one.

-

Benefit: Orders under $800 value enter the US Duty-Free. You save the entire 25% tariff. (Note: Best for FBM sellers).

Real-World Case Study: The $16,800 Saving

A lithium power bank seller we audited in Q4 2025 faced a projected duty hike from $7,200 to $24,000 on a single 40HQ container after Jan 1st.

The Fix: By shifting their top 3 FBM SKUs to Zbao's Section 321 fulfillment channel, they legally bypassed the tariff on individual orders.

Result: Effective tariff exposure was cut by 68%.

2. Duty Engineering & Smart Negotiation

Tariffs stack. A "Kitchen Chair" might get hit with Section 301 (Wood) AND Section 232 (Steel).

-

Strategy: Ship components separately (Kit) or re-classify based on essential character.

-

Negotiation: Don't let the factory dictate terms. If you are currently negotiating FOB terms properly, you can often push the "local charges" back to the supplier, lowering your Landed Cost by $500-$800 per shipment.

3. FCL Consolidation

If your Freight-to-COGS ratio is >20% because you ship LCL (Less than Container Load):

-

Strategy: Use Zbao Consolidation Services. We combine your 500 units with other clients to build a Full Container.

-

Benefit: You get FCL pricing (cheap) on LCL volume.

FAQ: Cost of Goods Sold

Q: Are Amazon PPC Ads included in COGS?

A: No. Advertising is a Selling Expense (Operating Expense). Including ads in COGS will mess up your gross margin calculation.

Q: Are Amazon Referral Fees included in COGS?

A: Generally, No. Referral fees are variable selling expenses. However, some sellers calculate "Contribution Margin" which includes these fees, but strict accounting keeps them separate from Landed Cost.

Q: Does using Zbao 3PL increase my COGS?

A: While 3PL fees are a cost, they often lower your total COGS by reducing expensive Amazon storage fees and avoiding Placement Fees. It is a trade-off that usually results in higher net profit.

Conclusion: Agility is Your Only Defense

The "China Tax" hasn't disappeared; it has just become more targeted.

In 2026, the sellers who win won't be the ones with the best photos—it will be the ones with the best math. If you sell Batteries, Furniture, or Medical Supplies, you need a logistics partner who understands the financial impact of every pallet.

Don't let the January 1st Tariff Cliff surprise you.

Contact Zbao Logistics today for a free Landed Cost Analysis. Let's see where we can trim the fat before the New Year.