China-to-US Freight Rate Forecast Q1 2026: CNY Shipping Cutoff Dates & Strategy

Ideally suited for: Importers shipping 5+ FEUs/quarter or managing $500K+ annual China-to-US logistics volume.

It is December 10th. If you are a supply chain manager or Amazon seller importing from China, you are currently standing at a critical decision point.

The Lunar New Year (CNY) falls on February 17, 2026. In the logistics world, this date acts as a massive gravitational force, pulling shipments forward and creating chaos in its wake.

In previous years, Q1 was a seller's market dominated by carriers. They would announce massive General Rate Increases (GRIs) and force shippers into bidding wars. However, shipping from China during Chinese New Year 2026 will not follow the usual pattern.

We are entering a unique market cycle defined by structural overcapacity—with a record 10 million TEU orderbook hitting the water—clashing with short-term seasonal bottlenecks.

At Zbao Logistics, we don’t just move containers; we analyze the data to protect your profit margins. Based on the latest trends from the Shanghai Containerized Freight Index (SCFI) and Drewry’s supply/demand models, we have developed this comprehensive Q1 2026 Freight Forecast.

This guide is your battle plan. We will reveal the hidden "South China Feeder Trap," the three waves of rate hikes you need to navigate, and our proprietary "Dual-Track" Booking Strategy that can save you 15% on your Q1 logistics budget.

1. Market Overview: Why 2026 is a Buyer's Market

If you feel like carriers are desperate for cargo despite their aggressive announcements, your intuition is correct. The fundamental backdrop for Q1 2026 is clear: Too many ships, not enough demand.

Structural Overcapacity by the Numbers

The global container shipping industry is facing an unprecedented surplus of capacity that will persist through 2029.

-

The Orderbook: The cumulative orderbook for new vessels has reached 10 million TEU, equivalent to approximately 32% of the active global fleet.

-

Supply vs. Demand: In 2026, global fleet capacity is projected to grow by 2.3%, while container trade demand is only expected to grow by 1.3%.

-

Drewry Index: The Drewry Supply/Demand for 2026 is projected at 85.4 (where 100.0 represents balance). This indicates a deep, structural imbalance.

Weak US Import Demand

US containerized imports are projected to decline by 3.4% in 2025/2026 due to inventory overhangs from the previous year. While there is a short-term rush to beat potential tariff changes on wood products, the overall macro consumption data suggests a soft Q1.

Zbao Insight: Carriers will try to use "Blank Sailings" (canceling voyages) to artificially inflate rates, but the sheer volume of new capacity makes it difficult for them to sustain high prices for long. This gives you, the shipper, significant leverage—if you know when to book.

2. The Three Waves of GRI (General Rate Increases)

Carriers are planning three distinct waves of rate hikes for Q1 2026. However, not all GRIs are created equal. Understanding which ones are "fake" and which ones are "real" is the key to smart negotiation.

Wave 1: January 1, 2026 (The "Formality")

-

Expected Hike: +$300 - $600 per FEU.

-

Probability of Success: Low (40-50%).

-

Analysis: This is a traditional New Year attempt to reset the market floor. However, historical data (2023-2025) shows that spot rates typically crash below the announced GRI within 10 days due to sufficient capacity.

Wave 2: January 15, 2026 (The "Space Squeeze")

-

Expected Hike: +$200 - $400 per FEU.

-

Probability of Success: Very Low (20-30%).

-

Analysis: This hike is driven by space tightness, not rate strength. Carriers will prioritize contract holders. The risk here isn't necessarily the price—it's "Rolling" (your cargo getting bumped to the next ship).

Wave 3: March 1, 2026 (The "Real Deal")

-

Expected Hike: +$500 - $800 per FEU.

-

Probability of Success: High (70%+).

-

Analysis: This is the most dangerous wave. As factories reopen after CNY (starting Feb 24) and backlog releases, carriers will implement aggressive blank sailings (cutting 5-8% of capacity) to support this hike.

3. Chinese New Year Shipping Cutoff Dates 2026 (South China Trap)

If you take only one thing from this article, let it be this section. The official holiday starts February 17, but the logistics network shuts down weeks earlier.

⚠️ The "South China Feeder Trap"

Many importers sourcing from Zhuhai, Zhongshan, Foshan, or Jiangmen make a fatal mistake: they assume the main port cutoff date applies to them.

It does not.

Feeder barges (small vessels that transport goods from local river ports to the main hubs in Shenzhen/Hong Kong) stop running 10-14 days earlier than the mother vessels.

-

Feeder Cutoff Date: January 8 - 12, 2026.

-

The Risk: If you miss this barge, your container sits in a small river port until March.

-

The Zbao Solution: If you miss the barge, we can arrange cross-border trucking to move your goods directly to Yantian or Shekou terminals, buying you an extra 5-7 days.

Shipping from Zhuhai or Foshan? Don't guess the barge schedule. Get a Free Feeder Cutoff Check from Zbao Logistics to confirm your exact deadlines.

Main Port Cutoff Dates (Gate-In Deadlines)

To ensure your cargo is loaded before the holiday, your container must be Gated-In (returned to the terminal) by these dates:

| Route / Mode | Recommended Cutoff | Est. Arrival (US) | Risk Level |

| US West Coast | Jan 15 - 20 | Feb 26 - Mar 6 | 🟡 Medium |

| US East Coast | Jan 10 - 15 | Feb 28 - Mar 8 | 🔴 High |

| Air Freight | Feb 1 - 5 | Feb 6 - 12 | 🟢 Low (High Cost) |

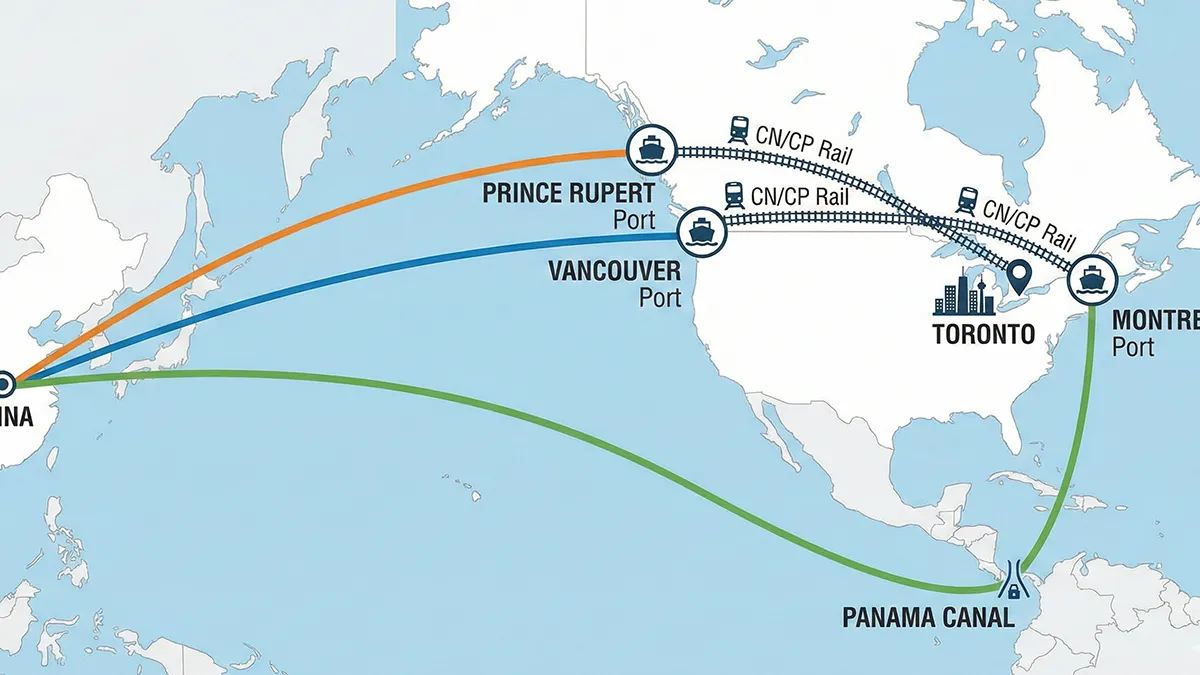

Note: US East Coast shipments are higher risk due to potential Panama Canal transit times and draft restrictions.

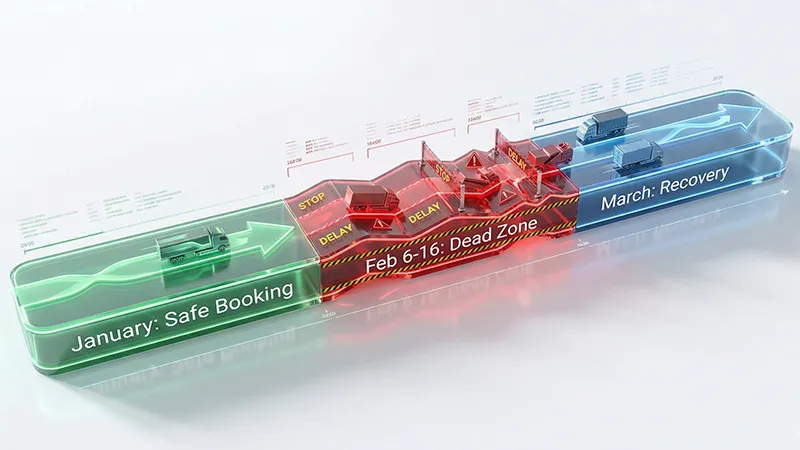

🚫 The "Dead Zone": February 6 – February 16

Do not attempt to move cargo inside China during these 10 days.

-

Trucker Exodus: 90% of drivers have returned to their hometowns.

-

Cost Spike: The few remaining drivers charge 3x rates (jumping from $400 to $1,500 per trip).

-

Gate Closures: Many factory warehouses are locked.

In short, shipping from China during Chinese New Year 2026 is all about hitting the right cutoff dates and avoiding the South China feeder trap.

4. Rate Trajectory – The "M-Shaped" Curve

Based on our predictive models, we forecast an "M-Shaped" price trajectory for China to US shipping costs in Q1 2026. Understanding this curve allows you to time the market.

Phase 1: The Pre-CNY Rush (Jan 15 - Feb 5)

-

Spot Rate: $2,100 - $2,300 / FEU.

-

Status: Expensive but Necessary for urgent Q1 stock.

Phase 2: The Factory Shutdown Crash (Feb 6 - Feb 23)

-

Spot Rate: $1,450 - $1,600 / FEU (Lowest of the year).

-

Status: Buying Opportunity. This is the perfect time for LCL consolidation if you have stock produced and ready at a 3PL warehouse.

Phase 3: The Post-CNY Rebound (Feb 24 - Mar 10)

-

Spot Rate: $1,650 - $2,000 / FEU.

-

Status: Fair Value. Rates rise from the bottom but remain lower than the January peak.

5. Zbao's Exclusive "Dual-Track" Booking Strategy

Given this volatility, a "one-size-fits-all" strategy will lose you money. We recommend adopting a 70/30 Dual-Track Strategy for your Q1 bookings.

Track A: The Security Track (70% Volume)

-

Booking Window: January 1 - January 15.

-

Target Rate: ~$1,900/FEU.

-

Strategy: Lock in the majority of your critical inventory before the January 15th chaos. Do not wait for rates to drop; the goal here is certainty.

-

Zbao Advantage: We utilize our block space agreements to ensure your containers are not rolled, even as space tightens.

Track B: The Opportunity Track (30% Volume)

-

Booking Window: February 24 - March 10.

-

Target Rate: ~$1,650/FEU.

-

Strategy: Save 30% of your budget for the post-holiday dip. As factories reopen, demand is initially slow, and carriers offer aggressive spot rates to fill empty slots.

-

Ideal For: Summer inventory, replenishment of non-critical SKUs, and end-to-end freight forwarder from China to Amazon FBA USA consolidations.

Success Story: In Q1 2025, one of our FBA clients shipping 40 FEUs saved 18% on total freight spend by deliberately shifting 30% of their volume into the "February Valley" window using our Dual-Track strategy.

Want to see the math for your own shipments? Request a free 70/30 simulation with your real SKUs.

6. People Also Ask: Top CNY Shipping Questions

Use this section to quickly find answers to the most critical shipping questions for Q1 2026.

How Much More Expensive Is Shipping from China During Chinese New Year 2026?

Expect to pay a premium of $300-$500 per container (roughly 15-25% increase) if you ship during the peak window of Jan 21 - Feb 5, compared to the post-holiday lows. This premium covers Peak Season Surcharges (PSS) and secures space on overbooked vessels. However, smart shippers can avoid this by booking early in January or waiting until late February.

What Is the Last Safe Time to Ship from China Before CNY 2026?

To be safe, your Purchase Orders (POs) should have been placed by December 1, 2025. If you are placing orders now (mid-December), you must confirm that your supplier can finish production by January 25th. Any later, and you risk missing the last vessels before the "Dead Zone" (Feb 6-16). For South China ports, the safe cutoff is even earlier: January 8th.

7. 2026 Contract Negotiation – The B2B Playbook

If you are a large volume shipper negotiating annual contracts, now is the time to strike. The spot market weakness gives you immense leverage.

The Data Argument:

Do not let carriers anchor negotiations on the January GRI. Use the Structural Overcapacity data:

"Mr. Carrier, global fleet growth is 2.3% while demand is only 1.3%. Drewry forecasts a 16% rate decline. We expect our 2026 contract to reflect this reality."

Zbao's Negotiation Targets:

-

Base Rate: Target -10% to -15% below your 2025 average contract rate.

-

Target Range: $1,680 - $1,780 / FEU (Shanghai to US West Coast).

-

Structure: Don't lock 100% fixed. Go for a 60% Fixed / 40% Spot mix to take advantage of the market dips we predict in Q2 and Q3.

8. Your 8-Stage Action Plan (Execution Checklist)

Use this checklist to manage your logistics team through Q1.

-

Dec 10 - Dec 20: Confirm "Last Production Date" with all suppliers. Identify "South China" risks.

-

Dec 20 - Dec 31: Submit bookings for Track A (70% volume). Target ETD Jan 1-15.

-

Jan 1 - Jan 10: Monitor the Wave 1 GRI. If it fails (as expected), push for spot rate discounts.

-

Jan 15: DEADLINE. All US West Coast cargo must be Gated-In.

-

Jan 20 - Feb 1: Ensure all supplier payments are wired. Banks close Feb 1.

-

Feb 1 - Feb 5: Last chance for Air Freight. Read our 2026 China-to-US freight rates guide to budget for this.

-

Feb 6 - Feb 20: DO NOT SHIP. The Dead Zone. Focus on planning Q2 orders.

-

Feb 24: Execute Track B (30% volume) bookings. Target the market bottom.

9. Commercial Solutions – Partner with Zbao Logistics

Navigating the 2026 Q1 market requires more than just a forwarder; it requires a strategist.

At Zbao Logistics, we provide B2B clients with the intelligence and infrastructure to beat the market. We specialize in managing high-volume supply chains for importers shipping 5+ containers per quarter.

Why Choose Zbao for Q1?

-

Space Protection: While others get rolled in January, our "Space Hold" agreements keep your cargo moving.

-

Smart Routing: We automatically divert South China cargo to Shenzhen main ports if feeder barges are missed.

-

Rate Arbitrage: Our hybrid pricing model ensures you pay the Contract Rate when the market is high, and the Spot Rate when the market crashes in February.

Ready to secure your supply chain?

👉 [Click Here to Get Your Q1 2026 Freight Quote]

Lock in your pre-CNY space today and get a free breakdown of your 2026 contract potential.

10. FAQ – Common Q1 Shipping Questions

Q: Will shipping rates go down in 2026?

A: Yes. Due to structural overcapacity (record new vessel deliveries), ocean freight rates are projected to decline by 10-15% overall in 2026 compared to 2025. Zbao Logistics helps you access these structural savings through smart contract negotiations.

Q: What is the latest deadline to ship before Chinese New Year 2026?

A: For US West Coast shipments, the critical Gate-In deadline is January 18, 2026. For feeder ports in South China, it's Jan 8-12. Zbao Logistics monitors these specific gate-in and feeder deadlines daily to ensure your containers don't get stranded.

Q: What is the difference between GRI and PSS?

A: GRI is a negotiable base rate hike; PSS is a fixed seasonal surcharge. Zbao Logistics negotiates your contracts based on market reality, helping you distinguish between 'fake' GRIs and real peak season charges.

Q: What is 'Rolled Cargo' and how likely am I to get rolled?

A: Rolling means your container is bumped to a later ship. The probability is 50-70% in late Jan. Zbao Logistics clients use our Tier-1 Contract Allocations to secure 'No-Roll' protection during the peak season.