The April Inventory Gap: Why "Waiting for Lower Rates" is a Trap

It is January 16. Ocean freight rates just spiked due to the mid-month GRI (General Rate Increase).

We see the newsletters from major competitors talking about "Tariffs" and "Global Disruptions."

But your CFO just wants to know one thing: "Can we wait until March to ship? Rates will be cheaper then."

As a standard logistics provider, we could just say "Yes" and book you for March.

But as your strategic partner in China, Zbao Logistics has to warn you: You are doing the math wrong.

You are calculating the Cost of Freight.

You are ignoring the Cost of the "April Inventory Gap."

Based on our on-the-ground factory data in Dongguan and Yiwu, combined with the latest 2026 Amazon algorithm trends, here is why waiting is a strategic suicide.

Part 1: The Timeline Reality (Why April is Dark)

Many importers look at the calendar and assume: "Chinese New Year ends February 24. Great, production starts then."

This is misleading.

Our data from manufacturing hubs confirms a much slower reality for 2026. Here is the actual timeline:

-

The "Ghost" Weeks (Feb 24 - Mar 8): While factories technically "reopen," only admin staff return immediately. Production lines run at <30% capacity as migrant workers slowly travel back from inland provinces.

-

The Real Start Date (March 10): Industry consensus indicates that factories will not reach Full Production Capacity until March 10, 2026.

-

The Logistics Lag: Even if your goods are finished on March 10, you face post-holiday congestion and Blank Sailings (capacity cuts by carriers).

-

Cargo Ready: March 10

-

ETD (Depart China): March 18 (Best case)

-

ETA (Arrive USA): April 4

-

Amazon Check-in: April 15

-

The Gap: If your current inventory runs out on Feb 20, you will be Out of Stock (OOS) for 55 days.

Part 2: The "Hidden" Cost of OOS (Amazon Algorithm)

You might think: "I'll just lose 55 days of sales. I can afford that to save $600 on shipping."

No, you can't.

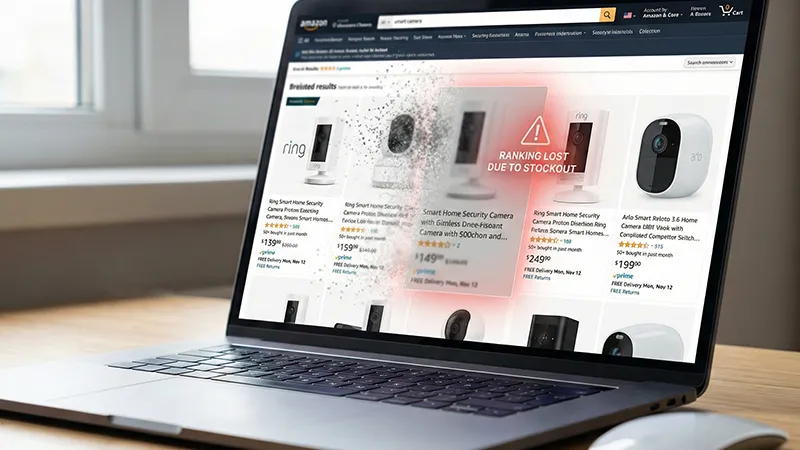

We analyzed the 2026 updates to Amazon's A9 Algorithm. The cost of a stockout is not just lost revenue; it is lost rank.

1. The Velocity Trap

Amazon ranks products based on Sales Velocity.

-

Day 1-7 of OOS: Amazon "holds" your rank slightly.

-

Day 8+ of OOS: Your Best Seller Rank (BSR) crashes. Amazon stops indexing your keywords because you have zero conversion data.

-

Result: By the time your "cheap" shipment arrives in April, you aren't on Page 1 anymore. You are on Page 10.

2. The "Re-Launch Tax"

When you finally restock in April, you can't just resume sales. You have to pay to get your rank back.

-

The Cost: Industry data suggests you will need to spend 2x to 3x your normal PPC budget for 3-4 weeks to regain your organic position.

-

The Math: If your normal ad spend is $2,000/month, your "Re-Launch Tax" is an extra $4,000 - $6,000.

The Verdict: You saved $600 on freight to spend $6,000 on ads. You lost $5,400.

Part 3: The Zbao Calculation

Let's compare your two choices right now (Jan 16).

| Variable | Scenario A: Ship NOW (Jan 16-20) | Scenario B: Wait for March |

| Freight Cost | High (Pre-CNY Peak) | Lower (Marginal savings) |

| Stock Status | In Stock (March/April) | OOS (55 Days) |

| Lost Revenue | $0 | **-$55,000** (assuming $1k/day) |

| BSR Ranking | Stable / Growing | Tanked / Invisible |

| Re-Launch Cost | $0 | **-$5,000** (Extra PPC) |

| Net Impact | Secure Q1 Profit | Loss of ~$60,000 |

💡 Soft CTA:

Not sure if these numbers apply to your specific product?

Contact us for a quick assessment. We can calculate your exact OOS risk based on your current SKU velocity and factory location.

Part 4: Your Emergency Strategy (Act by Jan 20)

Other forwarders are just telling you to "wait." We are giving you a rescue plan. If you are reading this on Jan 16, you still have time.

1. The "Matson Bridge" (Speed)

You don't need to ship a full container if rates are too high.

-

Strategy: Identify your top 20% SKUs (the money makers).

-

Action: Book a Matson CLX (LCL) shipment immediately.

-

Speed: 11 days port-to-port. This arrives in late February, bridging the gap until your bulk order arrives in April.

2. The "Feeder Bypass" (Access)

Reports confirm that feeder barges in the Pearl River Delta (Zhongshan, Foshan) are suspending services between Jan 20-25.

-

Action: If your factory says "The barge is cancelled," call us.

-

Solution: We will truck your goods directly to Nansha or Yantian to catch the last deep-sea vessels departing Jan 26-28.

-

Read More: South China Port Strategy 2026

Frequently Asked Questions (FAQ)

Q: Is it really risky to wait until March after Chinese New Year?

A: Yes. While official holidays end in late February, factories do not reach full labor capacity until roughly March 10. Combined with carrier "Blank Sailings" (cancelled voyages), waiting often leads to stock arriving in mid-to-late April.

Q: How long does Amazon FBA ranking take to recover after OOS?

A: It depends on the duration. If you are Out of Stock for more than 30 days, Amazon's algorithm treats your product as "new" (losing history). Recovering your previous BSR typically takes 3-4 weeks of aggressive PPC spending.

Q: Can Matson CLX really bridge a 30-45 day gap?

A: Absolutely. Matson CLX offers an 11-day transit from Shanghai to Long Beach with dedicated terminals. If you ship an LCL emergency batch on Jan 20, it can be checked into Amazon FBA by mid-February, keeping your listing alive while your main stock arrives later.

Q: What if my supplier says production restarts earlier (Feb 25)?

A: Be skeptical. Suppliers often quote the date their office opens, not their production line. Ask them specifically: "When will 80% of your assembly line workers be back?" The answer is usually after the Lantern Festival (early March).

Summary: Logistics is Strategy

In 2026, supply chain management isn't just about moving boxes. It's about protecting your Cash Flow and Algorithm Ranking.

-

Waiting is a gamble on freight rates.

-

Shipping Now is insurance for your business.

Don't accept the "April Blackout." Contact Zbao today to book your emergency rescue shipment before the holiday freeze.