Amazon FBA 2026 Fee Changes Explained: The Profit Protection Guide for Sellers

Are Amazon FBA fees increasing in 2026?

Yes. Amazon has announced a comprehensive fee restructure for 2026. While the average increase is $0.08 per unit, specific categories face steeper hikes. Key updates include Inbound Placement Fees reaching up to $0.72/unit for items over 5lbs, and Aged Inventory Surcharges increasing by approximately 100% for stock aged 180–270 days. To mitigate these costs, sellers should consider Amazon-Optimized Splits and a 3PL Drip-Feed Strategy to optimize inventory placement.

I. Introduction: Is FBA Still Profitable in 2026?

For many Amazon sellers, 2025 was a year of stability. However, the 2026 FBA Fee Schedule introduces new complexity to the fulfillment landscape.

While the official Amazon 2026 Fee Announcement highlights a modest average increase, this aggregate figure masks a steeper reality for specific categories.

-

Heavy Items: Products over 5 lbs may see placement costs rise significantly due to new weight tiers.

-

Slow Movers: Inventory aged over 6 months faces doubled storage penalties.

-

Compliance: The new Inbound Defect Fee (which can reach up to $5.72/unit for severe non-compliance) adds a strict financial penalty for labeling errors.

The Reality Check:

Based on internal cost modeling at Zbao Logistics, a China-based freight forwarder with 25 years of experience, a standard 1lb phone case could see an estimated 11.5% increase in total logistics costs in 2026 if no optimization is applied.

Is FBA still profitable? Yes, but it requires adaptation.

To maintain margins in 2026, sellers must shift from a "Direct-to-FBA" model to a "Smart Logistics" approach—utilizing freight consolidation, transloading, and packaging optimization.

II. 2025 vs. 2026: The Critical Fee Changes

Amazon is adjusting fees to incentivize efficient inventory management. Understanding these nuances is key to avoiding penalties.

1. 2026 Fee Comparison Table

| Fee Type | 2025 Standard | 2026 New Rate | Impact |

| Fulfillment (Small Std) | $3.22 | **$3.47** (Est.) | +$0.25 / unit |

| Placement Fee (<5 lbs) | $0.27 (Avg) | **$0.33** (Avg) | +$0.06 / unit |

| Placement Fee (>5 lbs) | $0.35 (Avg) | **$0.72** (Avg) | Double for Heavy Items |

| Aged Inventory (180 days) | $0.15 / unit | **$0.30 / unit** | +100% Increase |

| Inbound Defect Fee | Small Fines | Up to $5.72 | Severe Penalty |

2. Inbound Placement Service Fee (Weight-Based Tiers)

Amazon incentivizes sellers to split shipments. The new structure punishes single-location shipments for heavy goods.

2026 Placement Fee Tiers (Minimal Splits):

-

Small Standard (<1 lb): Approx $0.27

-

Large Standard (1-5 lbs): Approx $0.35

-

Large Bulky (>5 lbs): Up to $0.72 (This is the "Profit Killer" for appliances/furniture).

3. Low-Inventory-Level Fee (FNSKU Granularity)

-

The Change: In 2025, this fee was calculated at the Parent ASIN level. For 2026, it shifts to the FNSKU (Variant) Level.

-

The Risk: Sellers with high variant counts (e.g., apparel with 5 sizes) must manage inventory depth more precisely. If "Size Small" drops below 28 days of supply, it may trigger fees even if "Size Large" is well-stocked.

III. The Financial Impact: Before & After Analysis

To understand the real-world impact, we modeled two common product scenarios using Zbao's shipping data.

Scenario A: The 1lb Phone Case ($25 Retail)

-

2025 Estimated Total Fee: $3.92

-

2026 Estimated Total Fee: $4.37

-

Increase: +$0.45 per unit (+11.5%)

-

Profit Impact: For a business with thin margins, this represents a notable profit erosion.

-

Annual Cost: For 5,000 units/year, costs increase by ~$2,250.

Scenario B: The 5lb Kitchen Appliance ($35 Retail)

-

2025 Estimated Total Fee: $6.11

-

2026 Estimated Total Fee: $6.36

-

Increase: +$0.25 per unit (+4.1%)

-

Note: This assumes you successfully avoid the high Placement Fee. If you pay the $0.72 placement fee, the cost increase jumps significantly.

Analysis: Small, low-value items face the highest percentage increase. Heavy items face the highest risk from placement fees.

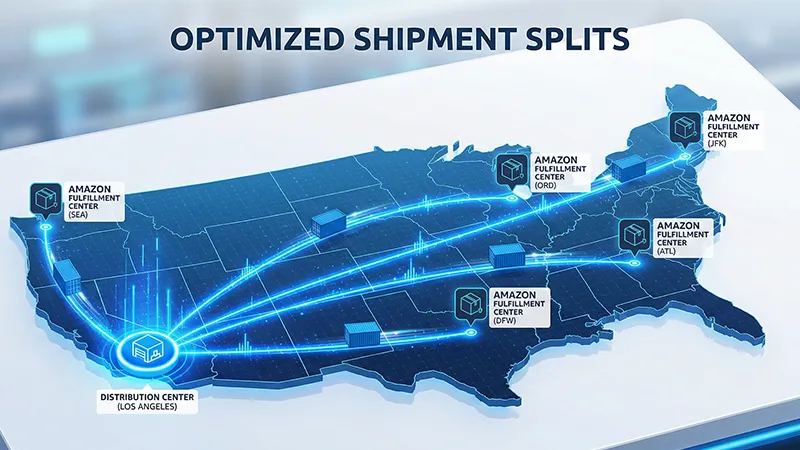

IV. The "Zero-Fee" Strategy: Amazon-Optimized Splits

Most sellers know they can pay a fee to send to a single warehouse ("Minimal Splits").

However, "Amazon-Optimized Splits" can result in a $0 Placement Fee.

How it Works

Amazon offers an option to split your shipment into 4-5 different Fulfillment Centers (e.g., East, West, Central). If accepted, the Placement Fee is Waived ($0).

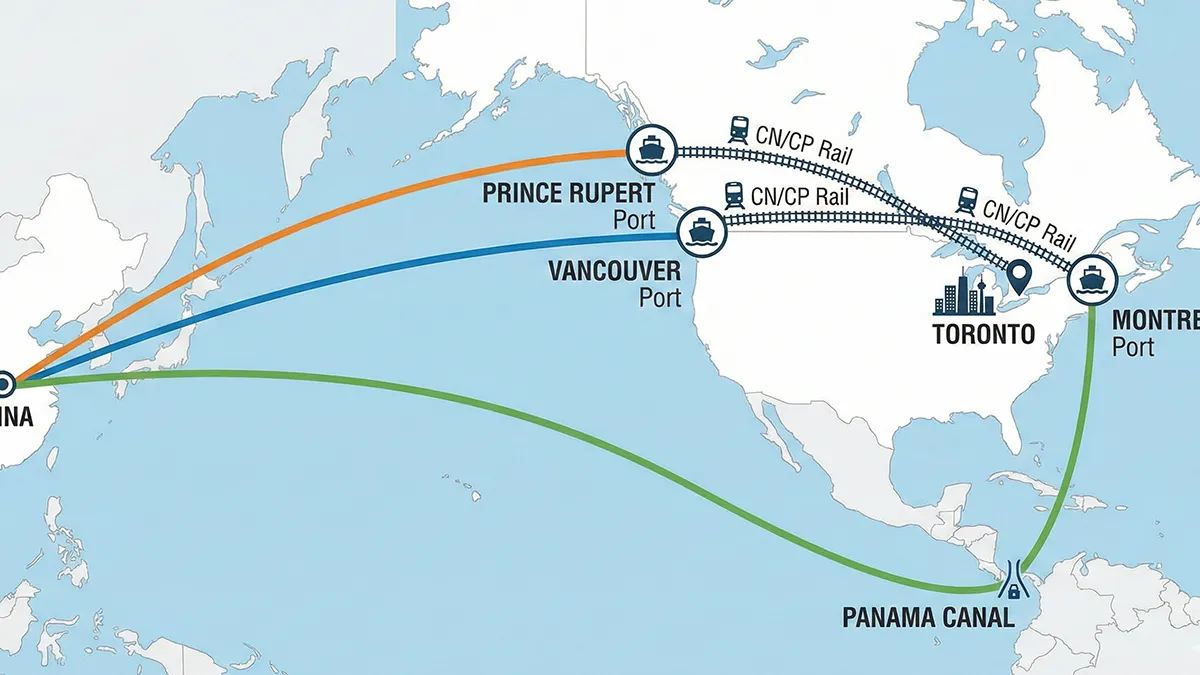

The Logistics Solution: Consolidation & Transload

A freight forwarder can bridge this gap. The workflow allows you to ship one bulk shipment from China, but deliver to multiple Amazon locations.

-

China Consolidation: Goods are received at our consolidation center in Shanghai/Shenzhen.

-

Ocean FCL (One Container): Inventory is loaded into a single container to maximize ocean freight savings.

-

US Transload: The container arrives at Zbao’s US Overseas Warehouse.

-

Sort & Dispatch: We break down the shipment and dispatch pallets via LTL to the 5 assigned Amazon FCs.

The Result: You benefit from bulk ocean rates while qualifying for the $0 Amazon Placement Fee.

V. Cost Comparison: Logistics Strategies

Let's apply this strategy to the 5lb Kitchen Appliance (5,000 unit shipment).

| Strategy | Logistics Method | Placement Fee | Logistics Cost | Total Est. Cost/Unit |

| A (Minimal Split) | Direct to 1 FC | ~$0.20 | ~$0.62 | $0.82 |

| B (Optimized Split) | Zbao Transload | $0 | ~$1.55 | **$1.55** (Expedited Availability) |

| C (SIPP + Optimized) | SIPP + Transload | $0 | ~$1.55 (-$0.90 Discount) | $0.65 (Cost Optimized) |

Note on Strategy C: By combining Optimized Splits with SIPP (Ships in Product Packaging) discounts, you achieve the lowest total cost. Zbao can assist with FBA Prep Services to ensure SIPP compliance.

VI. Additional Tactics: SIPP & Drip-Feed

1. SIPP (Ships in Product Packaging)

Formerly "SIOC". If your product can ship without an Amazon outer box, Amazon provides a discount (up to $1.32/unit depending on weight).

-

Implementation: Zbao can assist in coordinating ISTA 6-Amazon Testing with certified labs in China to validate your packaging.

2. The 3PL "Drip-Feed" Model

To mitigate the 100% Aged Inventory Fee hike, it is strategic to reduce long-term storage in FBA.

-

The Strategy:

-

Store bulk inventory at Zbao’s US Warehouse (Storage rates are typically 30-50% lower than FBA peak).

-

Replenish FBA every 2-4 weeks ("Drip-Feed").

-

Maintain lean FBA stock levels (30-45 days coverage).

-

VII. Your 2026 Readiness Checklist

-

Audit Margins: Calculate the "Before & After" costs for your top 20 SKUs.

-

Review FNSKUs: Analyze variant inventory levels to prepare for the new Low-Inventory Fee calculation.

-

Optimize Splits: Contact Zbao to discuss a Transload workflow for your next bulk shipment.

-

Verify Labeling: Ensure barcode readability to prevent the new Inbound Defect Fee.

VIII. FAQ: 2026 Fee Questions

Q: Does Amazon AWD (Warehousing & Distribution) waive the placement fee?

A: Yes. Utilizing Amazon's upstream storage (AWD) with auto-replenishment waives the placement fee. However, Zbao 3PL often offers faster receiving times (24-48 hours) compared to AWD.

Q: How do I calculate the Low-Inventory fee for new products?

A: New FNSKUs typically have a 180-day grace period immunity from this fee, allowing time to build sales history.

Q: Can Zbao help avoid Defect Fees?

A: Yes. Our Amazon FBA Services include comprehensive prep: labeling, bundling, and visual inspection in China to ensure compliance before shipping.

IX. Conclusion: Adaptability is Key

The 2026 fee changes signal a shift towards greater supply chain efficiency. While costs are rising for certain fulfillment models, opportunities exist for sellers who optimize their logistics.

By leveraging strategies like Optimized Splits, SIPP, and 3PL Drip-Feeding, sellers can mitigate fee increases and protect their bottom line.

Assess your 2026 logistics strategy today.

👉 Contact Zbao Logistics for a free shipping analysis and quote.