How to Find Your HTS Code for U.S. Imports from China

Your HTS Code (Harmonized Tariff Schedule Code) tells U.S. Customs the exact duty and clearance requirements for your goods.

Here’s how to find it in four steps:

-

Search the official USITC HTS database and enter your product name.

-

Review the 10-digit code that matches your product and its origin (China).

-

Confirm with your supplier or freight forwarder—export HS codes often differ from U.S. HTS.

-

If uncertain, check the CBP Rulings Online Search System (CROSS) at https://rulings.cbp.gov/ for official examples.

For complete accuracy, Zbao Logistics verifies every HTS code before shipment and integrates it into your DDP or FBA shipping plan.

Introduction

Accurate HTS classification is the foundation of compliant international trade.

When you import goods from China to the United States, the Harmonized Tariff Schedule (HTS) code determines how much duty you pay, which government agencies review your cargo, and whether your shipment clears without delay.

Incorrect codes can cause overpayment, CBP penalties, or blocked FBA appointments.

That’s why Zbao Logistics, a China-based freight forwarder specializing in DDP/DDU and Amazon FBA shipping, helps importers and e-commerce brands identify the correct HTS codes long before the goods reach U.S. customs.

What Is an HTS Code and Why It Matters

The Harmonized Tariff Schedule of the United States (HTSUS) is the national extension of the Harmonized System (HS) developed by the World Customs Organization.

All physical products traded worldwide are defined under the six-digit HS system; each country adds its own final digits to specify tariff rates and regulations.

-

HS Example: 9403.60 – Wooden Furniture

-

U.S. HTS Example: 9403.60.8081 – Other Wooden Furniture (2.9 % duty)

Every digit matters — a single change can alter your duty rate or trigger FDA or EPA review.

For importers using DDP shipping from China, your forwarder declares the HTS on your behalf, so the responsibility to get it right is shared.

Learn how we manage this in our China-to-USA DDP Shipping workflow.

HTS vs HS vs Schedule B Codes

| System | Used By | Digits | Purpose |

|---|---|---|---|

| HS (Harmonized System) | WCO / Global | 6 | Universal product identification |

| HTS (Harmonized Tariff Schedule) | U.S. Customs (CBP / USITC) | 8–10 | Determines U.S. duties and regulations |

| Schedule B | U.S. Census Bureau | 10 | For U.S. exports and trade statistics |

Example: A plastic storage box may be exported from China under HS 3924.10,

but its U.S. HTS version 3924.10.4000 imposes a 3.4 % duty.

If you also export finished products from the U.S., you’ll need the matching Schedule B number found at the U.S. Census Bureau search tool

How to Find Your HTS Code (Three Reliable Methods)

1. Use the Official USITC HTS Search Tool

Visit hts.usitc.gov and search by product name or keyword.

You’ll see a list of codes with their descriptions and tariff rates.

Example Searches:

-

“LED lamp” → 8539.50.0010 (0 %)

-

“Wooden chair” → 9403.60.8081 (2.9 %)

-

“Plastic kitchenware” → 3924.10.4000 (3.4 %)

Tips: Use specific descriptions, check chapter notes, and verify that the duty rate applies to China as origin.

2. Verify with Your Supplier and Freight Forwarder

Suppliers in China typically include an HS code on their export invoice. However, that code may not match the U.S. HTS version.

At Zbao Logistics, we compare supplier codes with the latest USITC database and cross-reference them through the CROSS ruling system. This pre-classification step is included in our Customs Clearance Services so importers avoid reclassification penalties and warehouse holds.

3. Request a Binding Ruling from U.S. Customs (CBP)

If your product is complex or multi-material (e.g., smart home devices, tool kits, or textiles with electronics), apply for a Binding Ruling.

A ruling officially confirms the correct HTS classification and duty rate for future imports.

Submit a request to CBP through their CROSS database, including detailed specifications and images.

Once approved, CBP is bound by that decision, protecting you from post-entry penalties.

HTS Codes for Common Products Shipped from China

| Product | U.S. HTS Code | Duty Rate (approx.) | Notes |

|---|---|---|---|

| Plastic Storage Box | 3924.10.4000 | 3.4 % | Household plastic articles |

| LED Bulb | 8539.50.0010 | 0 % | Energy-efficient electronics |

| Wooden Furniture | 9403.60.8081 | 2.9 % | Subject to Section 301 tariffs |

| Cotton T-Shirt | 6109.10.0012 | 16.5 % | Requires precise fabric details |

| Power Adapter | 8504.40.9520 | 0 % | Electrical accessory |

| Pet Harness | 4201.00.6000 | 2.4 % | Check material composition |

| Metal Rack | 7326.90.8688 | 2.9 % | May trigger anti-dumping duty |

For consolidated DDP shipments that include multiple SKUs, we verify each classification and merge them into a single customs entry within our China-to-USA Shipping solution.

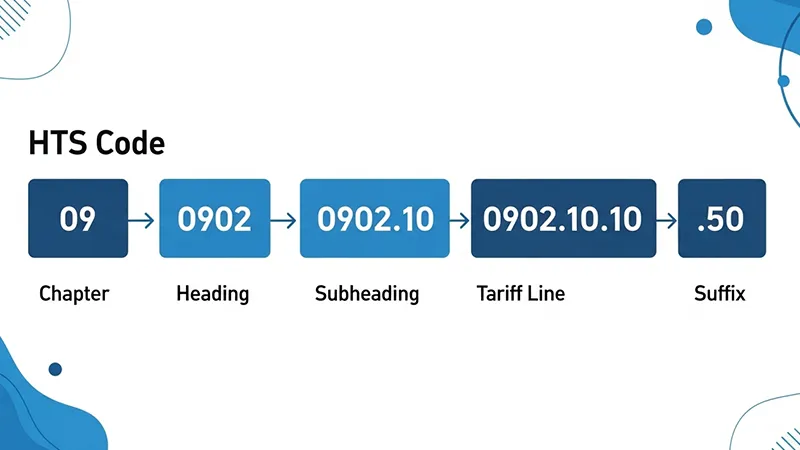

How to Read an HTS Code

Using Green Tea (0902.10.10.50) as an example:

| Digits | Meaning | Explanation |

|---|---|---|

| 1–2 | Chapter | 09 – Coffee, Tea, Spices |

| 3–4 | Heading | 02 – Tea |

| 5–6 | Subheading | 10 – Non-fermented green tea |

| 7–8 | Tariff Line | 10 – Duty Rate 6.4 % |

| 9–10 | Statistical Suffix | 50 – Organic variant |

Understanding this structure lets importers distinguish between similar items and prevent classification errors that impact duty costs.

Common Mistakes When Selecting HTS Codes

-

Copying the supplier’s HS without verifying the U.S. HTS.

-

Using overly broad descriptions like “electronics” or “toys.”

-

Ignoring annual USITC updates and Section 301 adjustments.

-

Assigning one code to mixed materials (e.g., metal + plastic).

-

Failing to update commercial documents after code changes.

We’ve helped importers recover overpaid duties and avoid repeated holds by reclassifying SKUs correctly. Read more in our Case Studies

What Happens If You Use the Wrong HTS Code

-

Overpayment: You can file a Post-Entry Amendment within 315 days to request a refund.

-

Underpayment: CBP may issue a bill plus interest and penalties.

-

Inspection Delays: Misclassified goods may require additional agency review.

-

FBA Delays: Incorrect ISF data causes appointment cancellations.

The solution is proactive verification. Zbao Logistics includes HTS checks in every Amazon FBA Shipping from China project so clients avoid these disruptions.

Zbao Logistics HTS Verification Process

-

Collect Product Information – specs, materials, photos, and supplier HS code.

-

Research Authoritative Sources – USITC HTS database and CBP CROSS rulings.

-

Confirm with Customs Partners – licensed brokers validate sensitive SKUs.

-

Integrate into DDP/DDU Quotes – accurate landed costs from day one.

-

Document Consistency – align HTS across invoice, packing list, ISF, and labels.

This workflow ensures compliance and transparency through the entire China-to-USA supply chain.

International HTS Variations

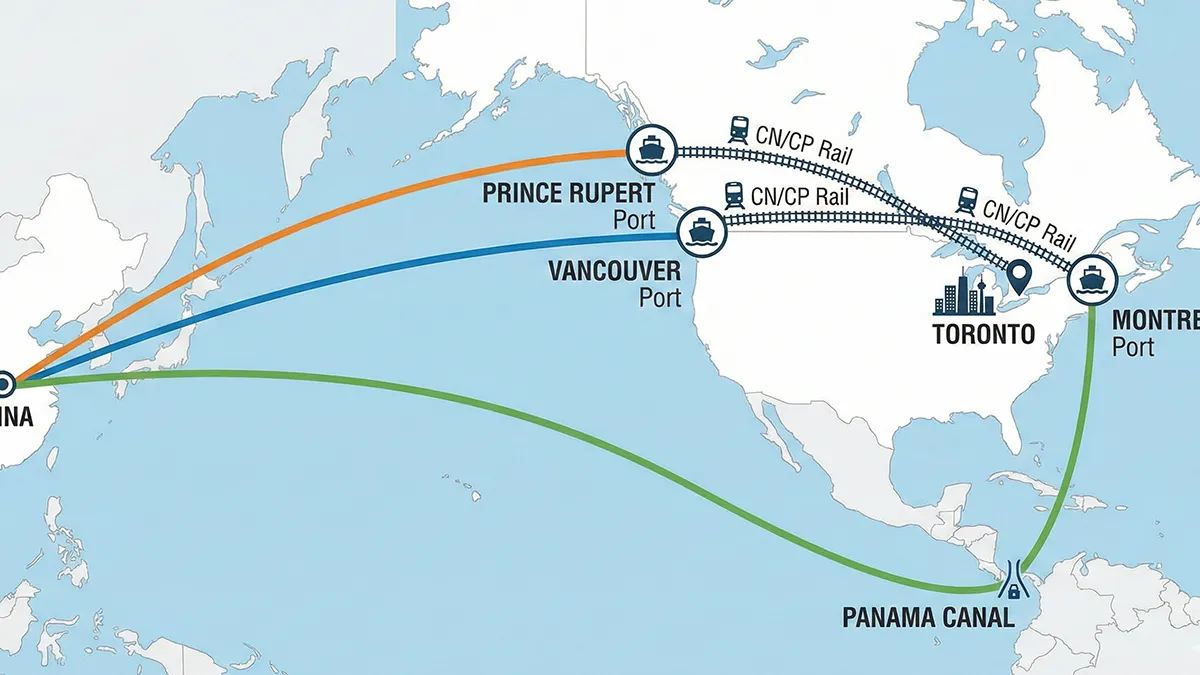

While this guide focuses on U.S. imports, Zbao also supports clients shipping to the UK, EU, Canada, and Japan. We map each product’s base HS to the destination country’s tariff system to guarantee correct duty assessment worldwide.

Practical Tips for Importers and FBA Sellers

-

Maintain an internal database of SKU → HTS → Duty → Source (USITC / Broker).

-

Re-verify annually; tariff updates occur each January.

-

Match HTS on every document (invoices, packing lists, ISF).

-

Use Binding Rulings for high-value or ambiguous items.

-

Always confirm codes before booking DDP/DDU shipments.

Conclusion

The correct HTS code is not just a number on a form—it defines your costs, compliance, and reputation with customs authorities.

Zbao Logistics helps importers, FBA brands, and distributors simplify this process through end-to-end logistics solutions that include HTS classification, customs filing, and door-to-door delivery from China to the U.S.

Ready to ship with accuracy and confidence?

Get a Quote

FAQs

1. What’s the difference between HS and HTS codes?

HS codes are six-digit international standards; HTS codes add extra digits used by U.S. Customs to define duty rates.

2. Do I need a Schedule B number too?

Only for U.S. exports. Use the Census Schedule B tool to find it.

3. Who assigns the HTS code in a DDP shipment?

Your forwarder or customs broker confirms it based on product specifications and CBP rules.

4. Can I use my supplier’s HS code for U.S. imports?

Not safely. Always verify with USITC or Zbao Logistics before filing entries.

5. How often are HTS codes updated?

USITC updates them yearly and after trade policy changes (e.g., Section 301). Check before each shipment.

6. Can Zbao Logistics help classify my SKUs?

Yes. HTS verification is built into our DDP/DDU and FBA solutions for China-to-U.S. shipping.